Training guide showing Flamingo walkthrough & processing Settlements in Boardwalk for NPSC clients.

Agenda

- Settlement Best Practices

- QuickBooks Online Deduction Scenario

- Login

- Navigation

- Simple Search

- Advanced Search

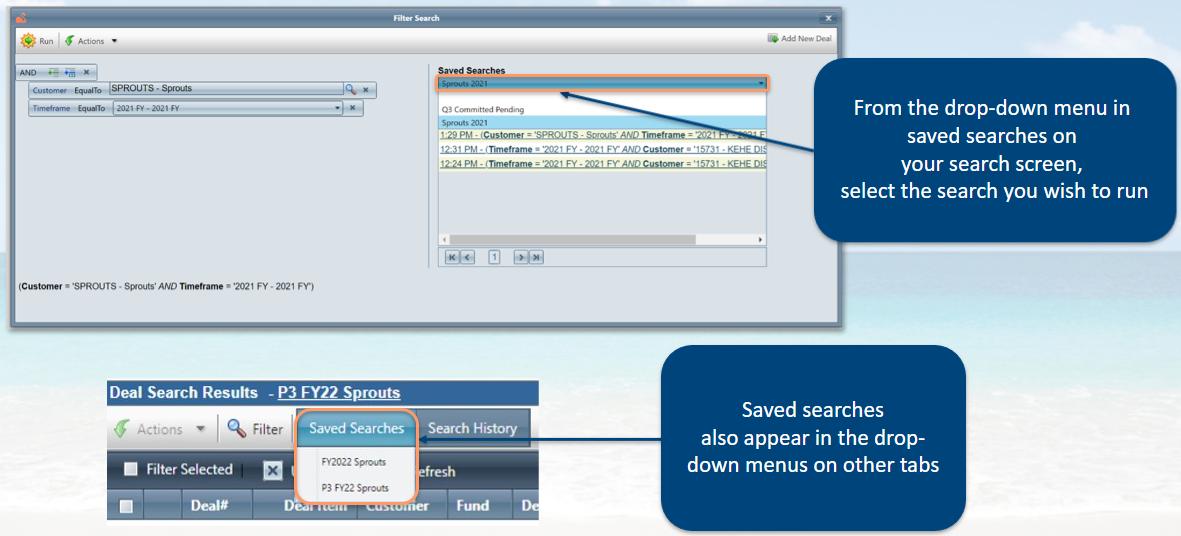

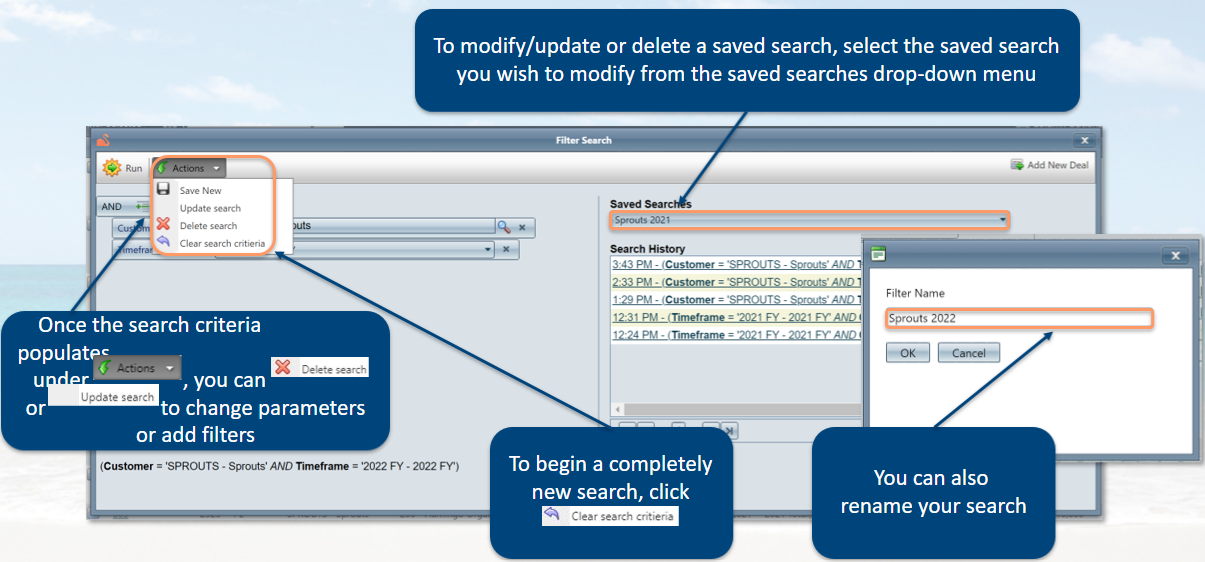

- Saved Searches

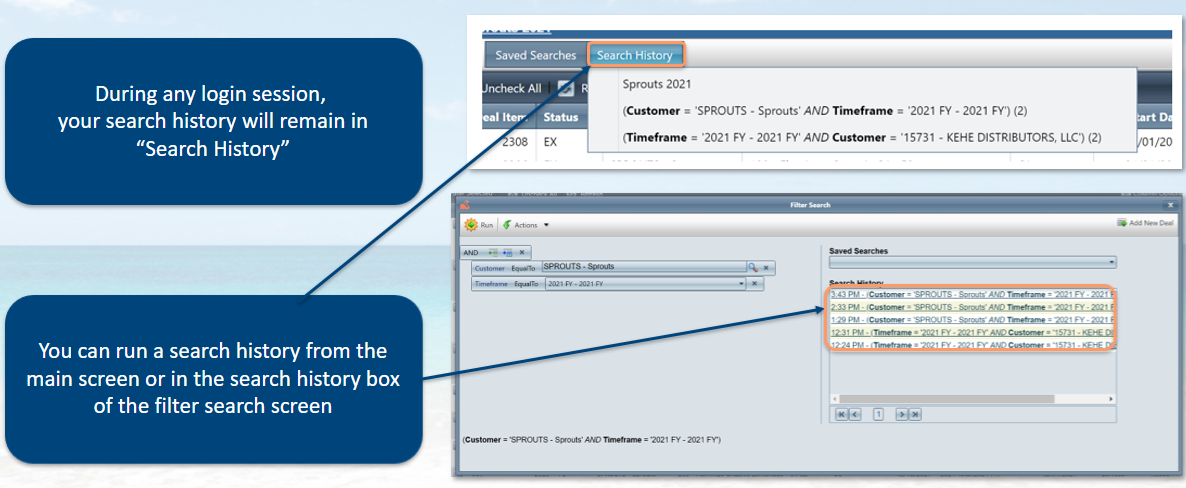

- Search History

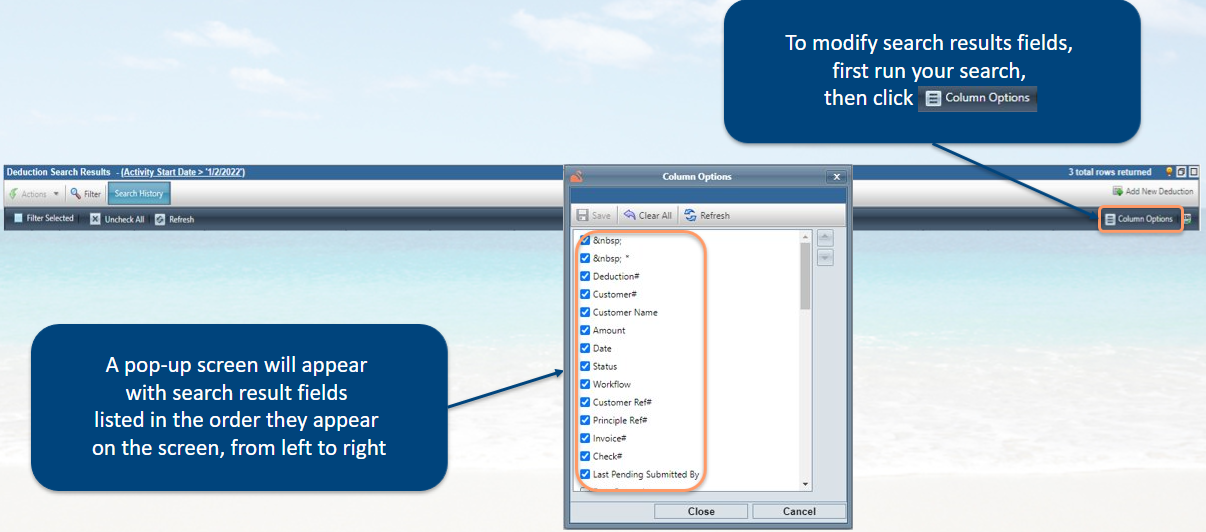

- Formatting Search Results

- Managing KeHE & UNFI Deductions In Flamingo

- Loading Deduction Backup

- Accessing Your Deductions

- Boardwalk Offset

- Option 1: Transfer A Deduction Between Customers

- Option 2: Non-Trade Deduction – Offset to GL

- Option 3: Splitting A Deduction

- 3a: Splitting A Deduction & Applying to Deals

- Viewing Deduction Offsets

- Managing Other Customers Deductions In Flamingo

- Option 1: Offset to Deal

- Option 2: Non-Trade Deduction – Offset to GL

- Option 3: Splitting A Deduction

- Deduction Workflows

- SMART Dashboards Deduction Reporting

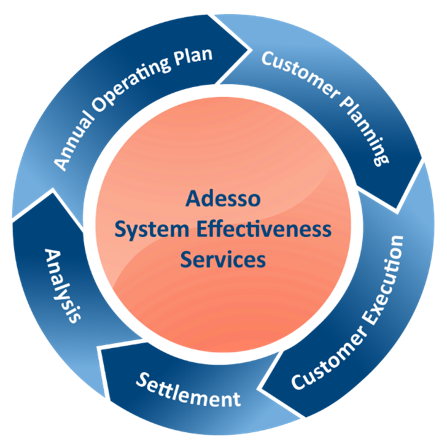

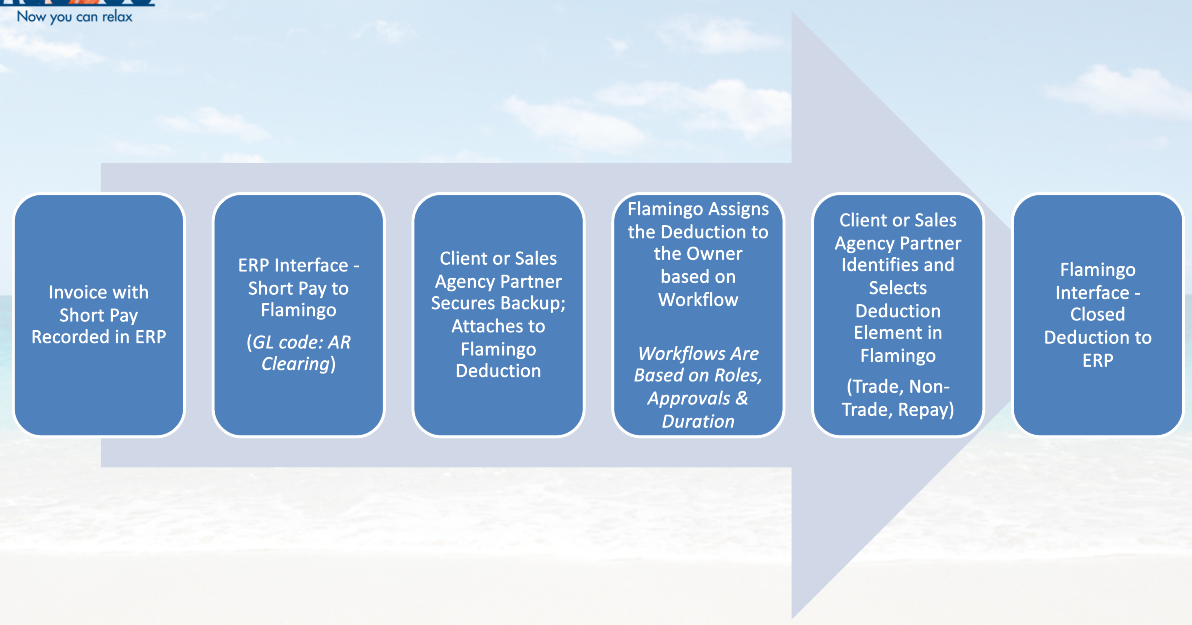

Business Process Overview

Settlement – Best Practices

- After an event has ended, payments are authorized to meet the terms of the contract. Off-invoices are settled at the time of invoice, while billbacks and lump sums will typically create a short pay or lead to an invoice from the retailer/distributor to the manufacturer for payment.

- Best practices:

- The key to effectively reducing your deduction balance is accurate planning and confirming plans

- Ensure all deductions are stored, organized, and processed in a central location

- Adhere to Days Sales Outstanding (DSO) objectives

- Process check requests in a consistent fashion to deductions to eliminate double dipping

- Sales agencies are a more effective resource for deduction backup and matching deductions to deals

- Attach backup to deductions and utilize comments

- Utilize workflows to manage deductions, i.e., trade and repays

- Login to Flamingo daily to check and address alerts

QuickBooks Online Deduction Scenario

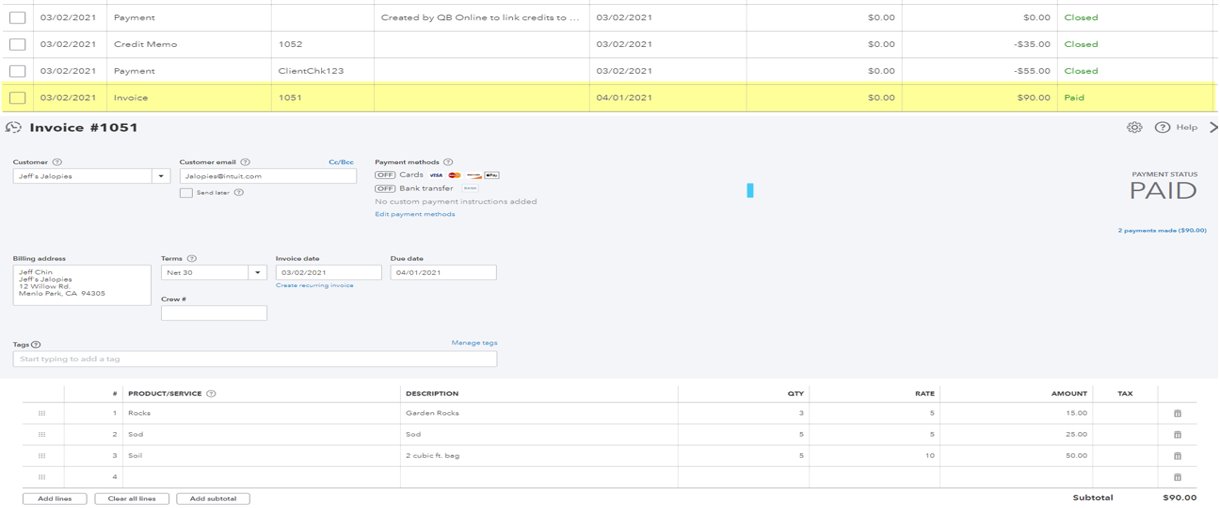

Basic Lifecycle of Invoice to Payment to Credit Memo

- Lifecycle: Invoice → Applying a Payment to the Invoice → Creating a Credit Memo to cover the difference → Quickbooks auto-generated Payment links the Credit Memo to the Invoice/Payment

QuickBooks Online Deduction Scenario

The Invoice

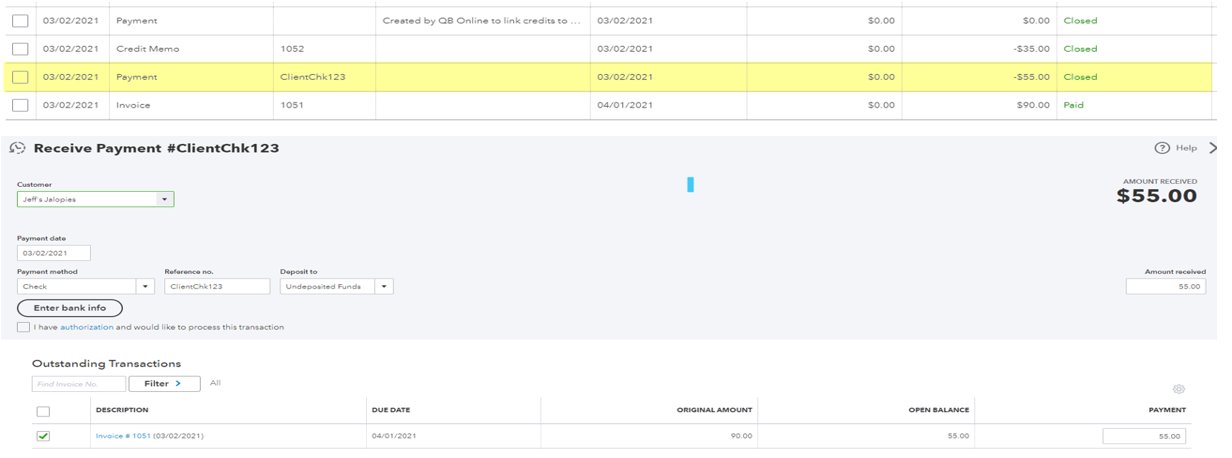

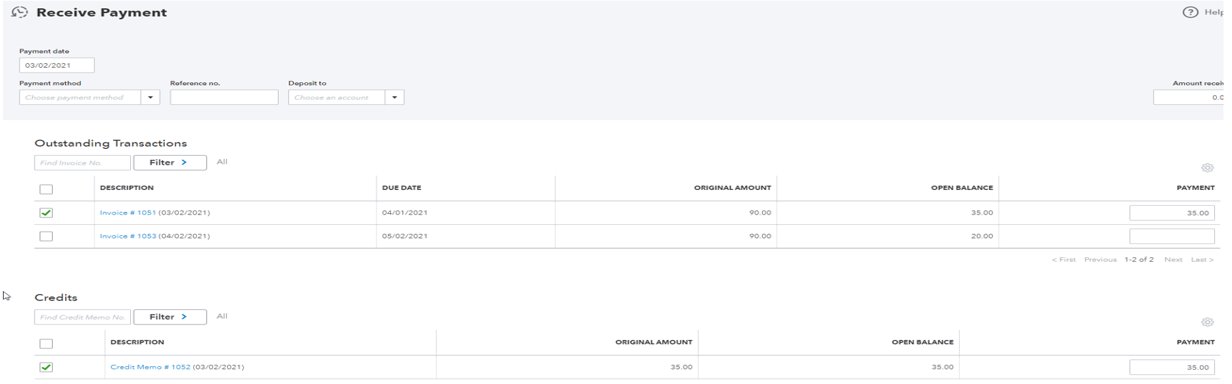

Customer Payment – Short Pay

- The customer pays $55 of the $90 invoice, leaving a $35 invoice balance

- In the Payment screen, the check is applied to Invoices

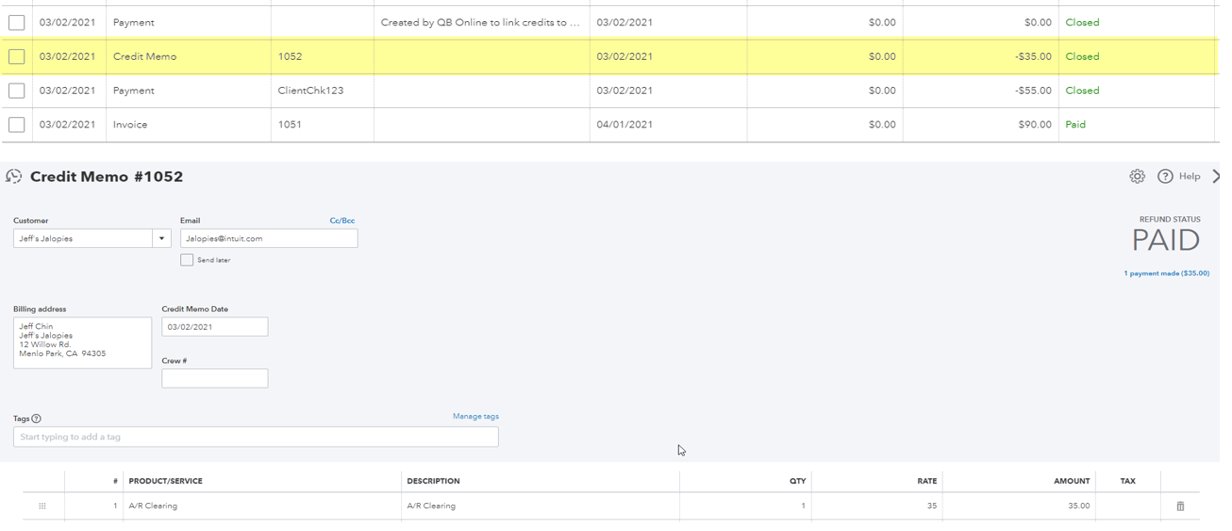

Credit Memo (Deduction)

- A Credit Memo is created to the AR Clearing Service Item for the $35 difference

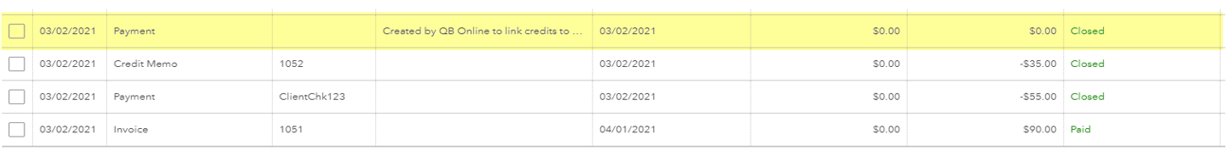

Quickbooks-Generated Payment – Links Credit Memo to Invoice

- This Payment created by Quickbooks is used to link the Credit Memo to the invoice

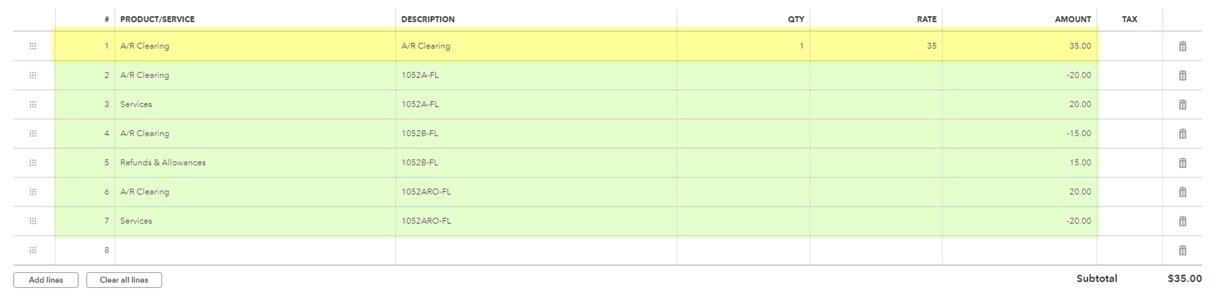

After Credit Memo Has Been Settled In Flamingo and Sent Back to Quickbooks

- We will append records to the original Credit Memo

- Deduction Settled Amounts are deducted from the AR Clearing Item and applied to the GL Item specified in Flamingo

- Note: The last 2 lines show a Re-open where we put the Amount back into the AR Clearing Item and out of the GL Item

We Will Initially Be Working in the Flamingo Test Environment

- Chrome is preferred browser

- https://login.adesso-solutions.com/

- Enable pop-ups on this site

- Business Code

- ClientNameTest: Training & Test Environment

- UserID: Unique to each user

- Password: Must be changed on first login

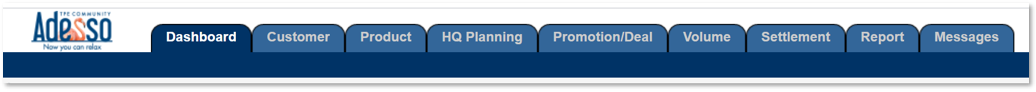

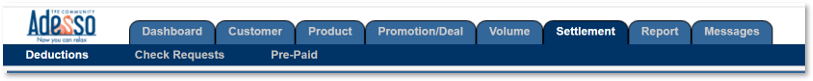

Navigation Overview

- Navigation In Flamingo Is Easy!

- Your options (tabs) may vary based on your security in the system

- Click a tab at the top of the navigation bar to move to that screen and access a filter box

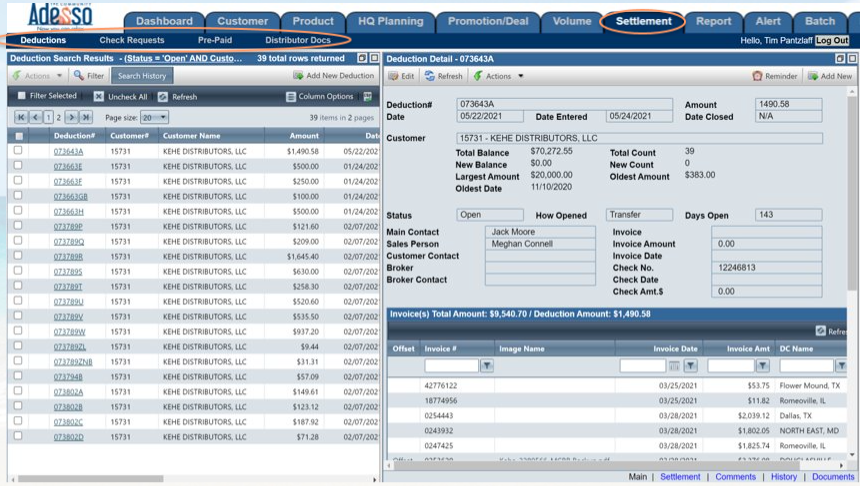

Settlement Overview

- All Deduction Activity Is Managed Through the Settlement Tab Sub-Menus

Simple Search

- Click and Make Sure You Are In the Deductions Sub-Menu:

- Depending On the Filter You Are In, You Can Search By:

- A screen will display the entire results of your search and individual items opened for review or action

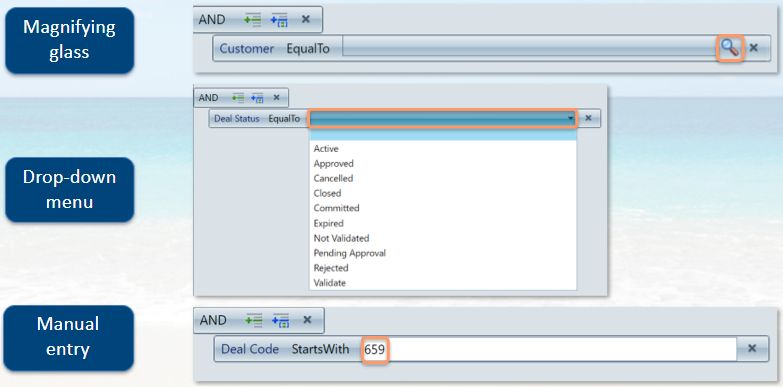

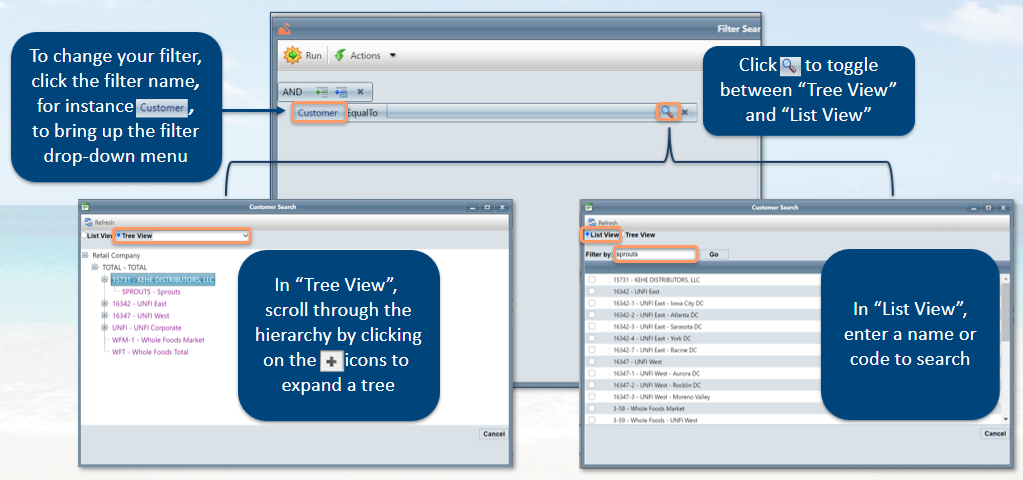

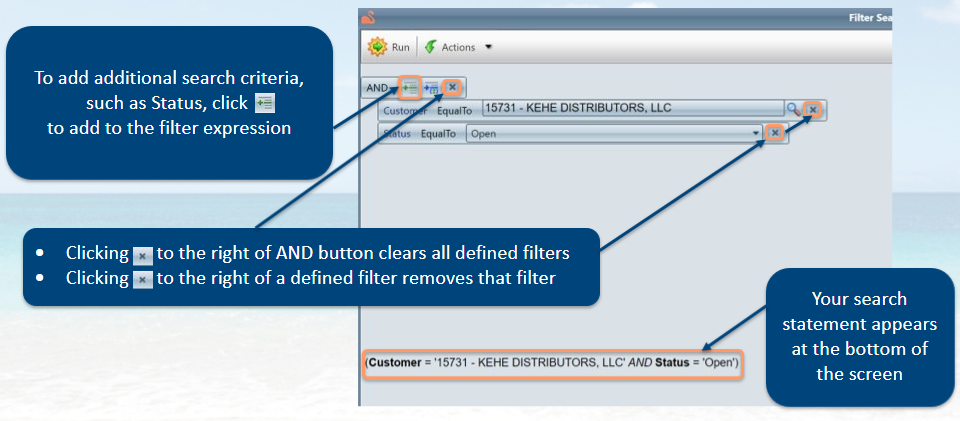

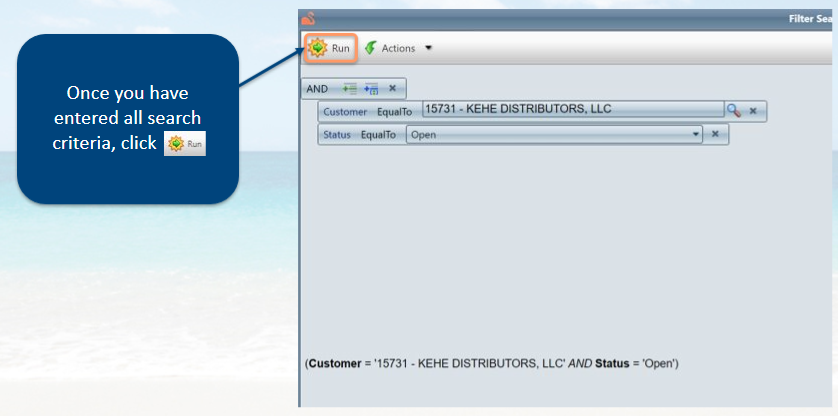

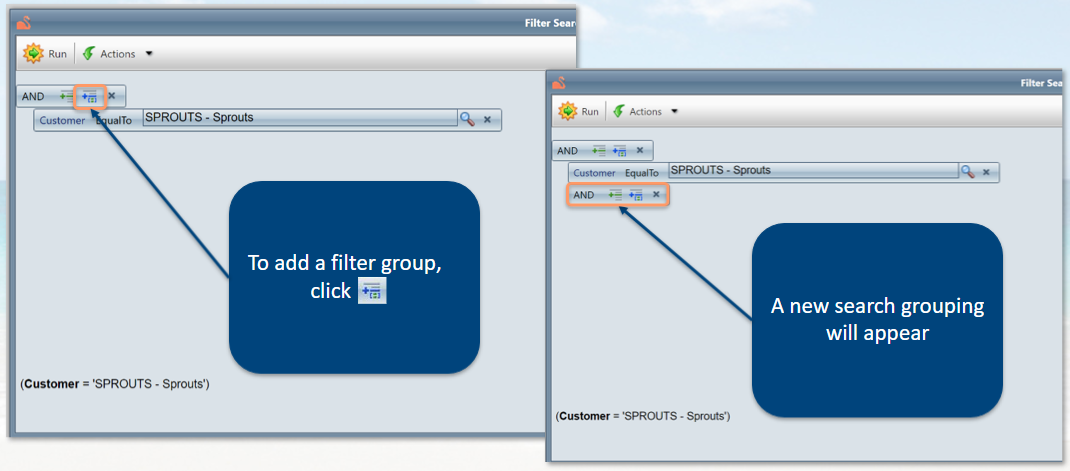

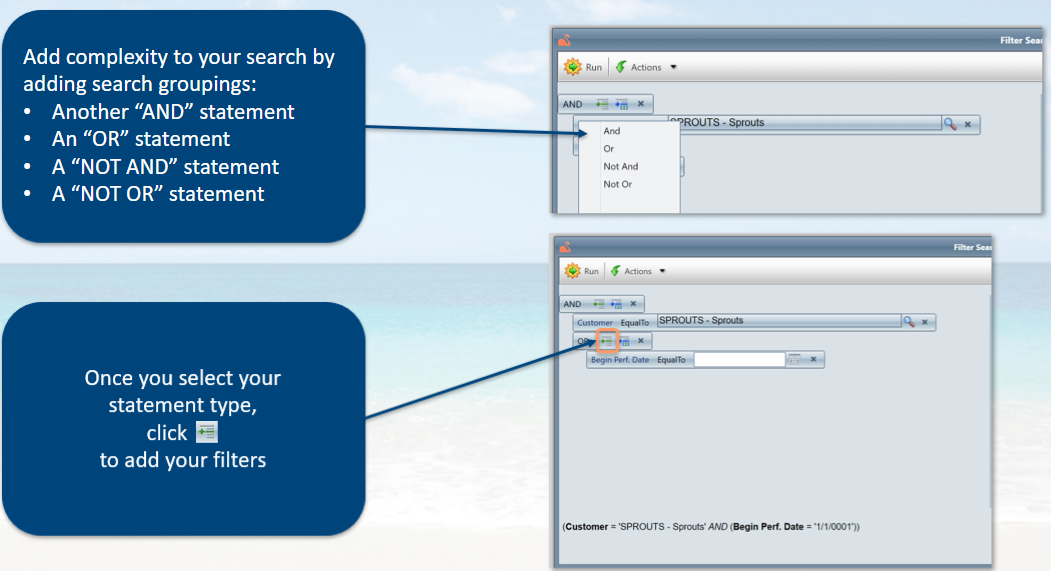

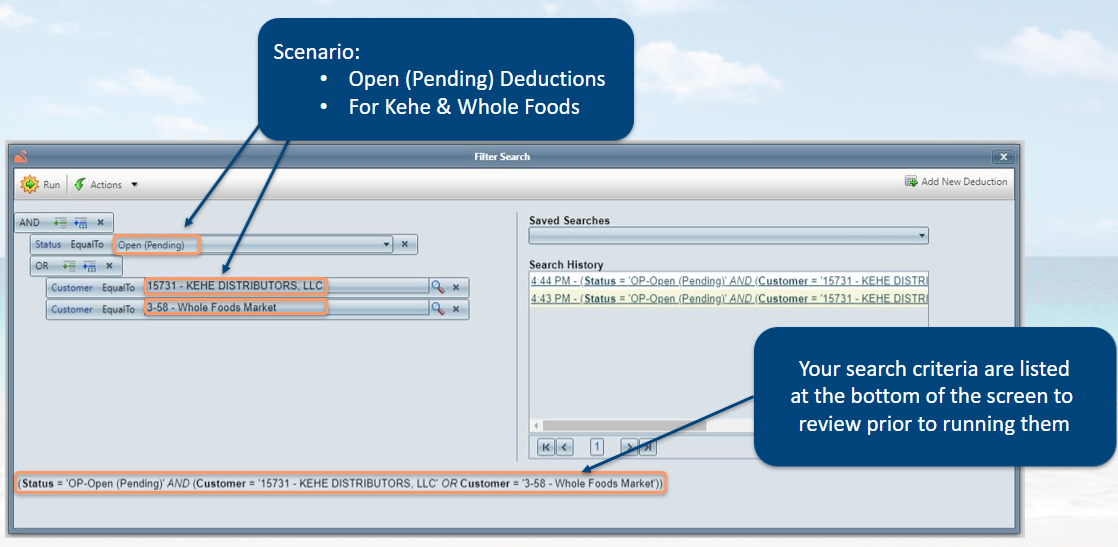

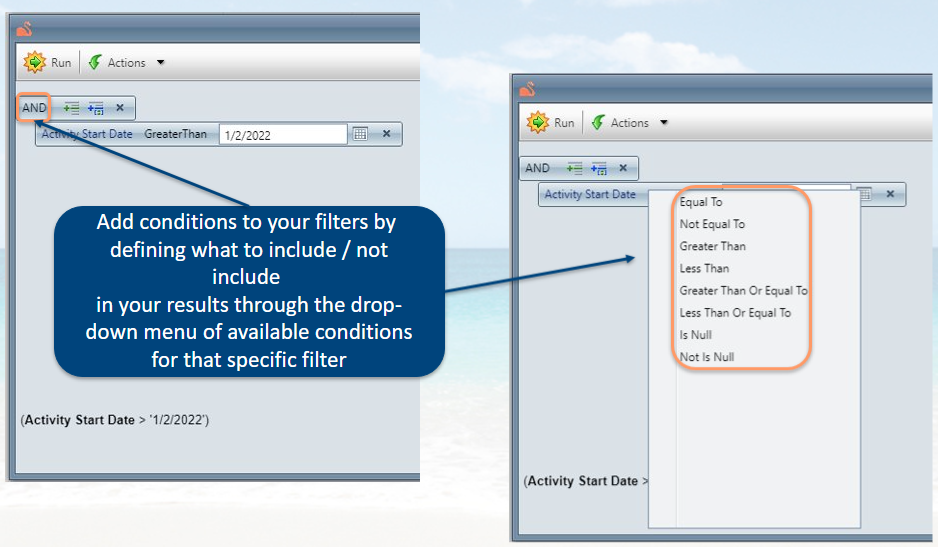

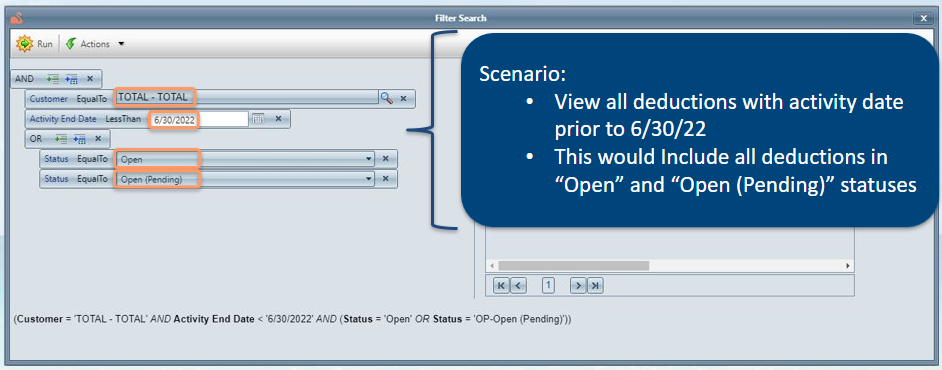

Advanced Search

- Filter Groups Add More Complexity to Your Search and, Coupled With “AND” and “OR” Statements, Enable You to Better Define Your Parameters

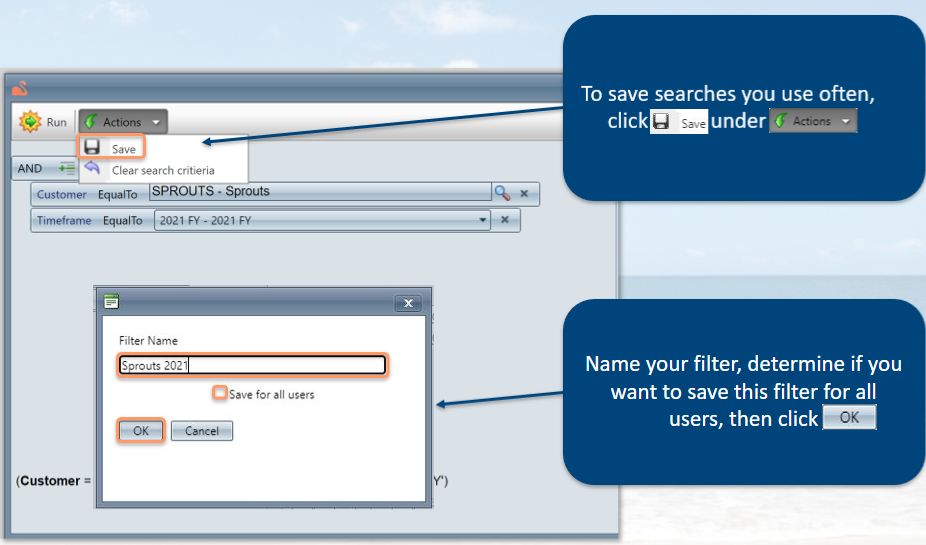

Saved Searches

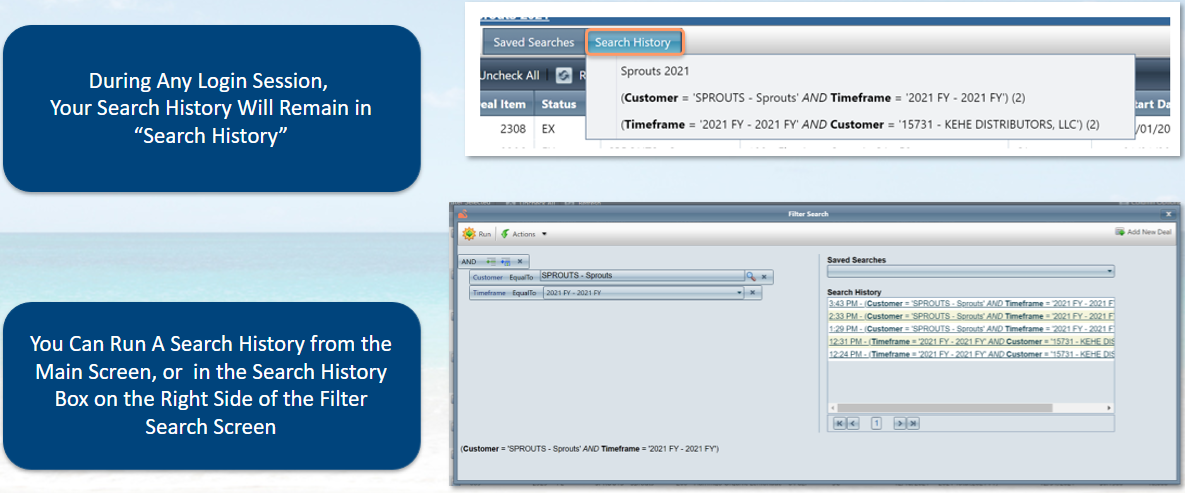

Search History

Formatting Search Results

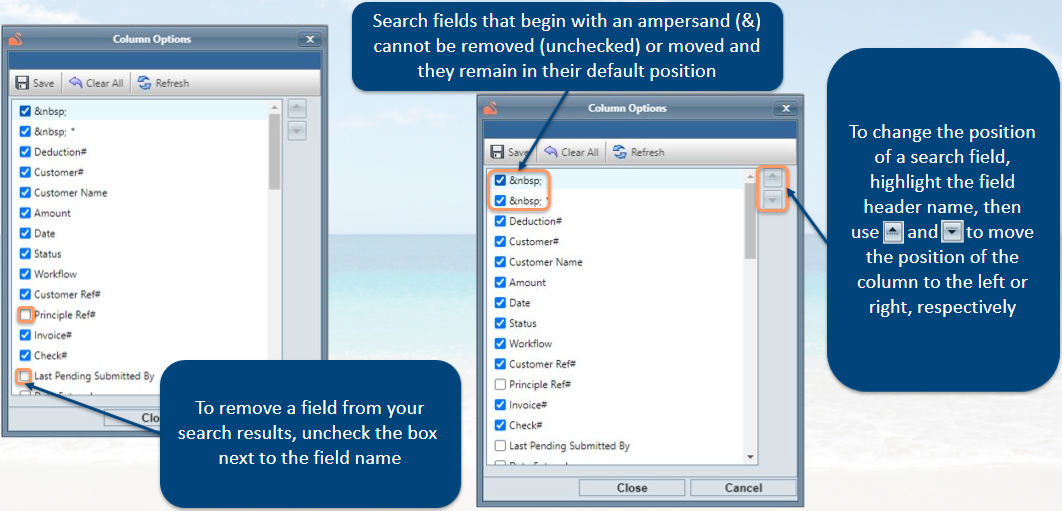

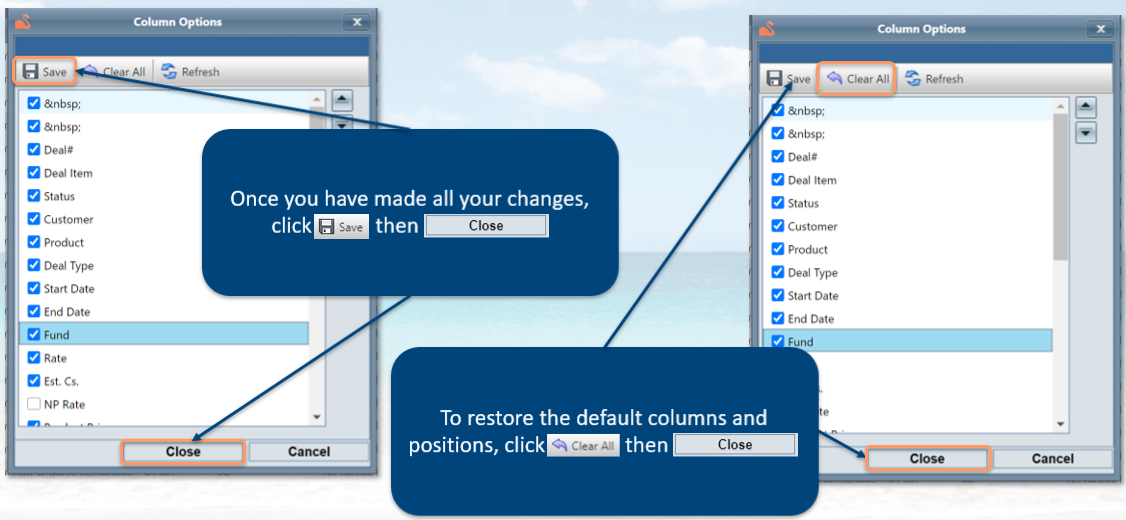

Column Options

- You Can Format Your Search Results To Rearrange and/or Hide Fields

Search History

Managing KeHE & UNFI Deductions

In Flamingo

Rapid Deduction Matching

- Situation

- KeHE & UNFI deductions are a slightly different, but both create a mess

- Large scale deductions can have a large impact on small NSO Companies

- A ridiculous number of pages of nonsense

- This is the same issue for all Natural & Specialty manufacturers

- KeHE & UNFI deductions are a slightly different, but both create a mess

- What does Boardwalk do?

- Aggregates & organizes the distributor backup into trade related and non-trade related deductions (Scan & OCR)

- Automatically matches trade related deductions to the appropriate deal (AI & Machine Learning)

- Benefits

- Reduce admin time (cited as over 95%) addressing settlements from the initial short-pay to the closing of the deal

- Quickly collect the ‘low hanging fruit’ of repays, and eliminating double-dipped promotions so you can move to deeper trade analysis and more effective promotions - benefiting both your business and your retail partners

- With the appropriate chart of accounts, Adesso clients know where every dollar is being spent

KeHE & UNFI deductions are a slightly different, but both create a mess

KeHE & UNFI Backup Is Where it Begins

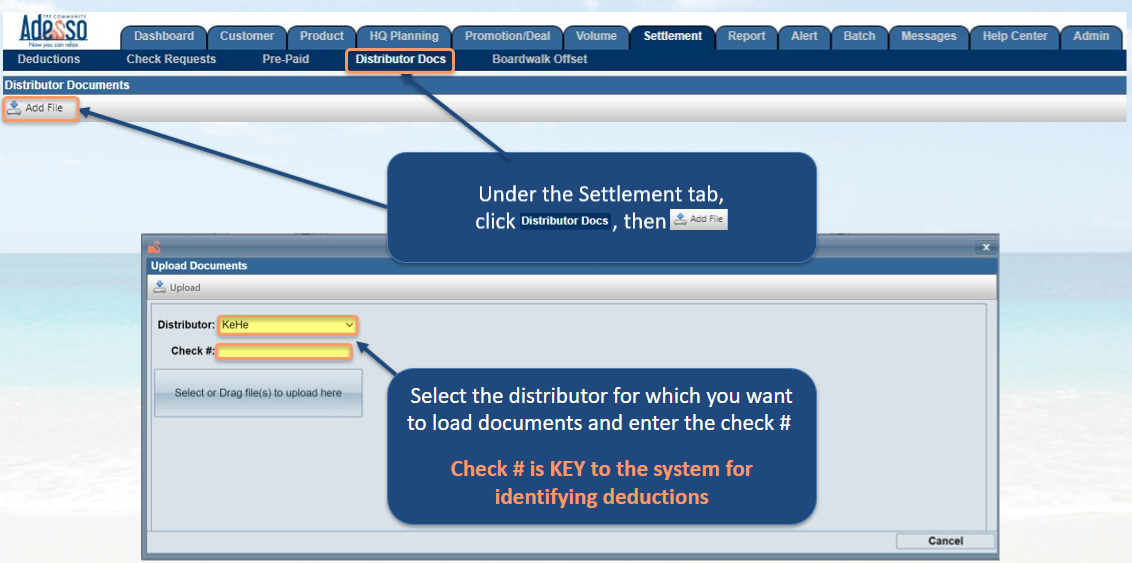

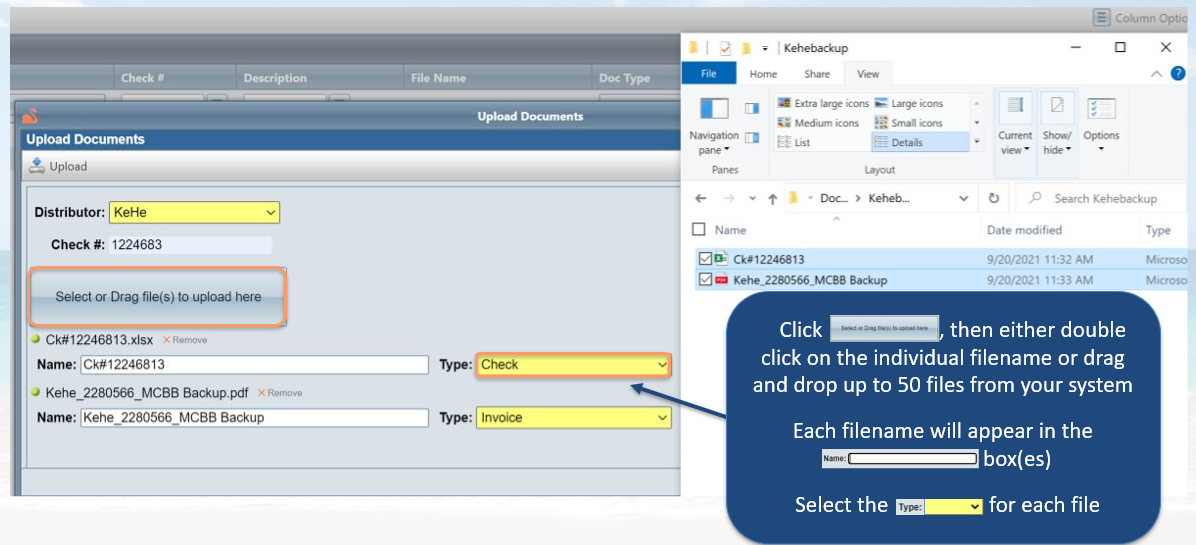

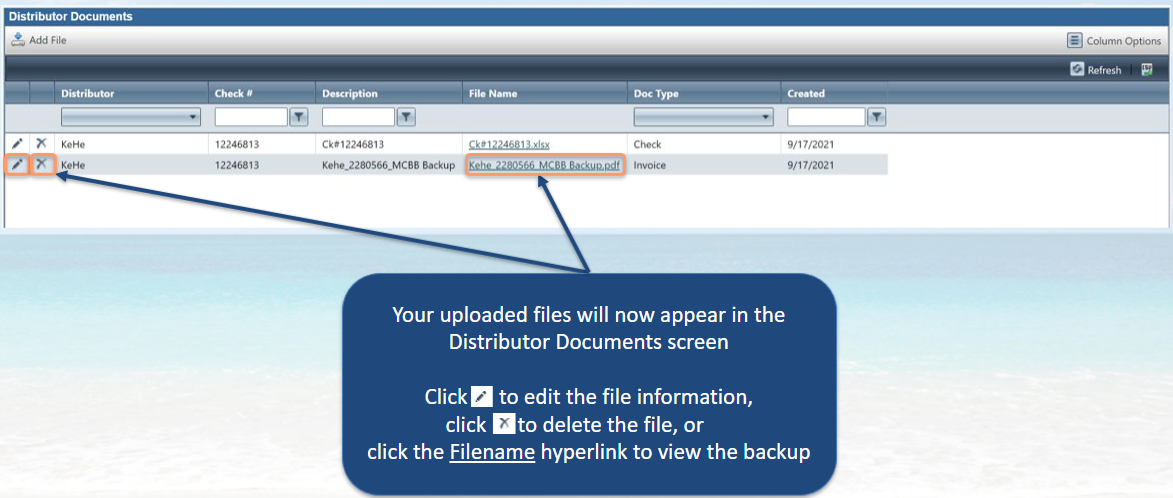

Uploading KeHE & UNFI Backup

Managing Distributor Documents

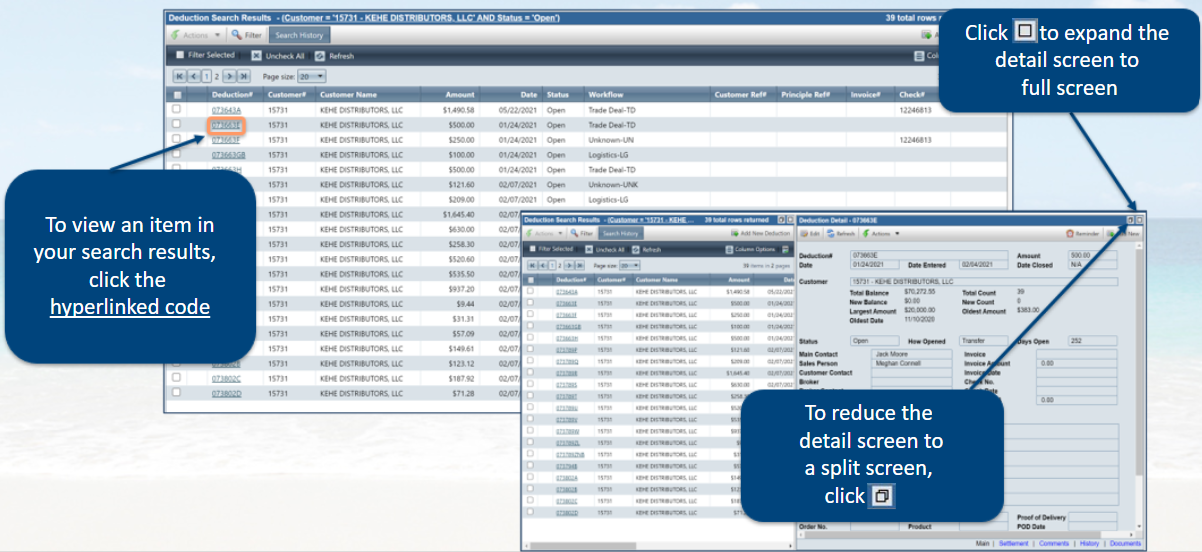

Deductions

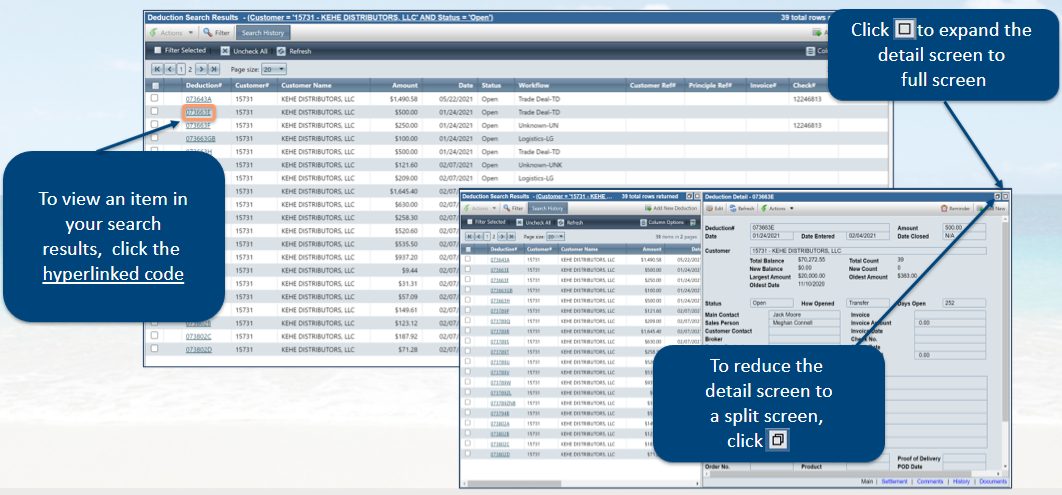

- The Settlement tab’s Deductions sub-menu is where you can access the list of all your deductions

- After you run your search, click on the Deduction # hyperlink to open the Deduction Detail screen.

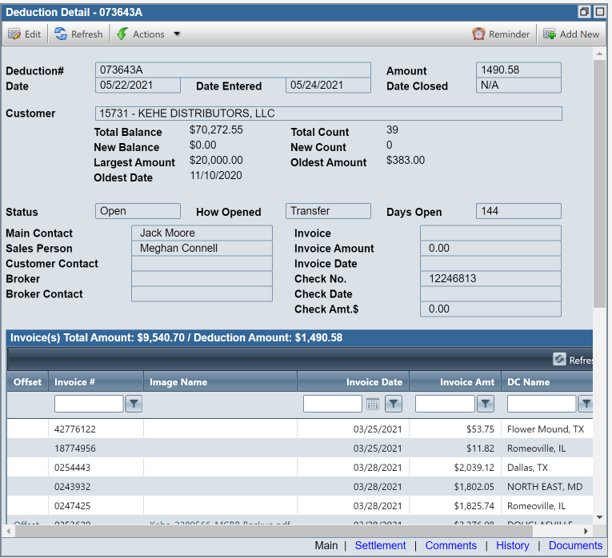

Deduction Detail & Invoice Register

- The Deduction Detail screen recaps information imported from your ERP and your uploaded distributor documents

- The Invoice Register is initially populated through the check backup. As backup is scanned into the system, it is attached to the appropriate deduction and allows the user to offset the deduction

- Additional information pertaining to the deduction can be accessed here

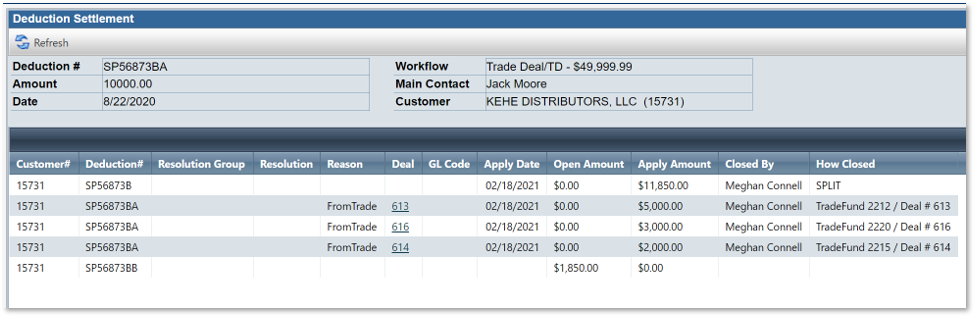

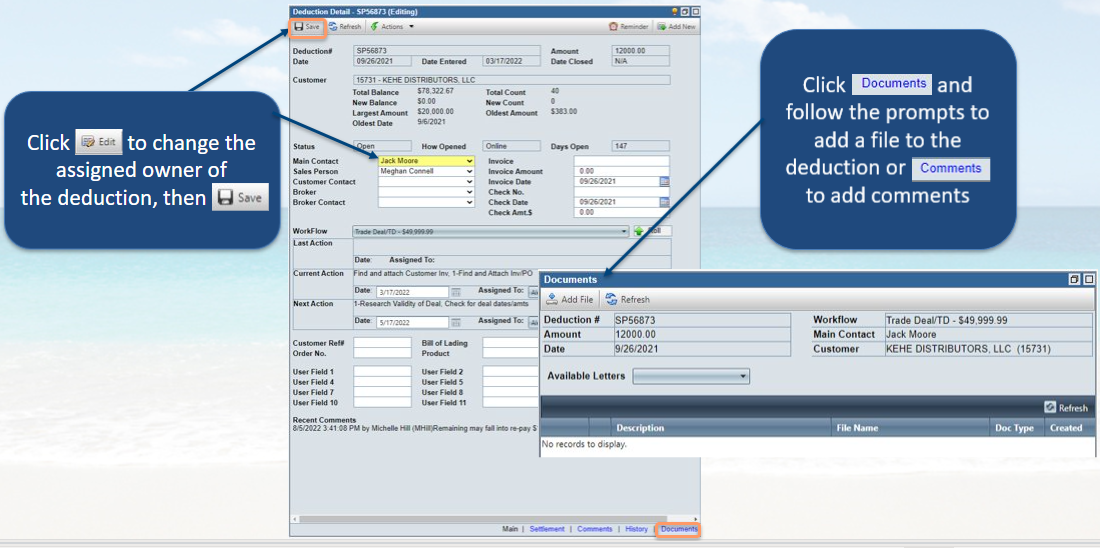

Deduction Detail

- The Deduction Settlement screen ONLY shows closed deductions and includes all relevant information and settlement transaction records related to that deduction

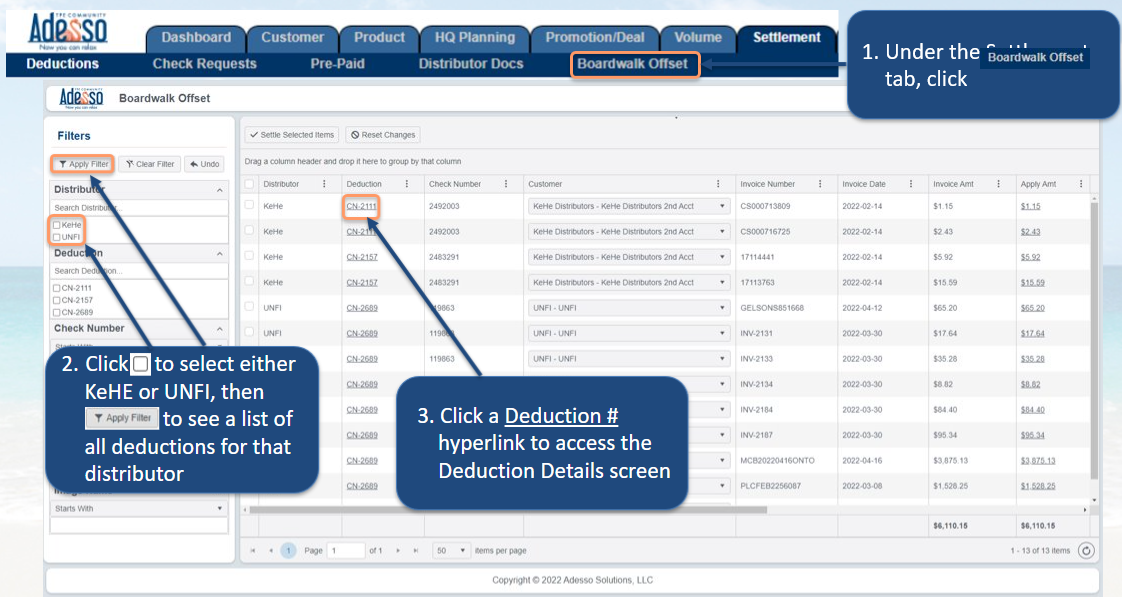

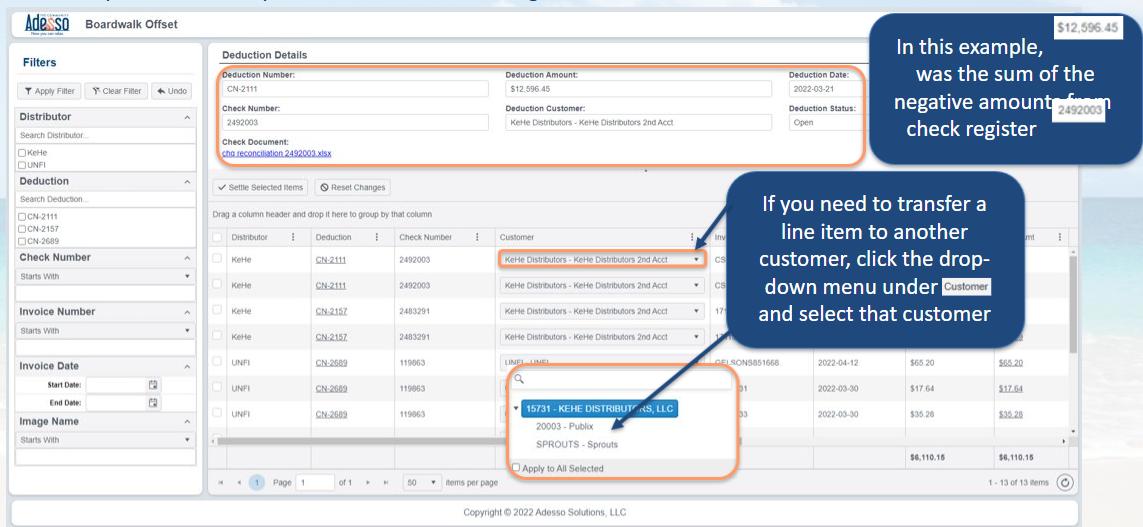

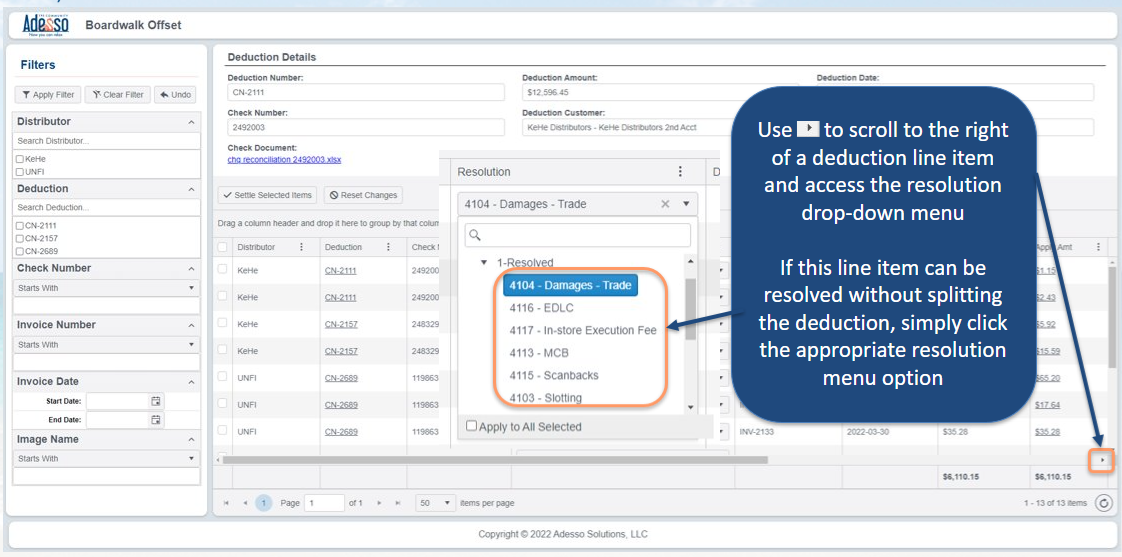

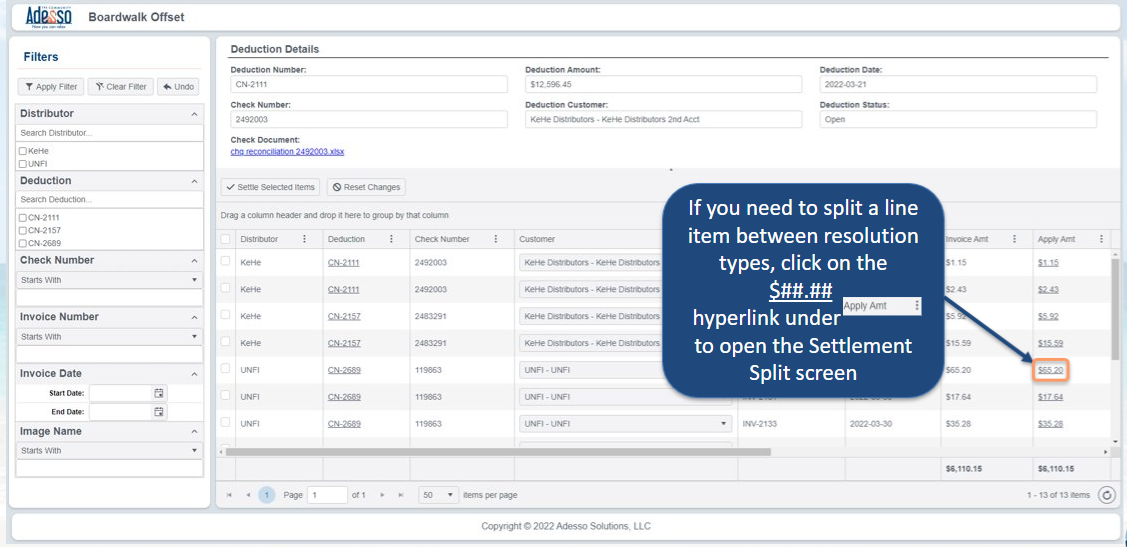

Boardwalk Offset – Step By Step

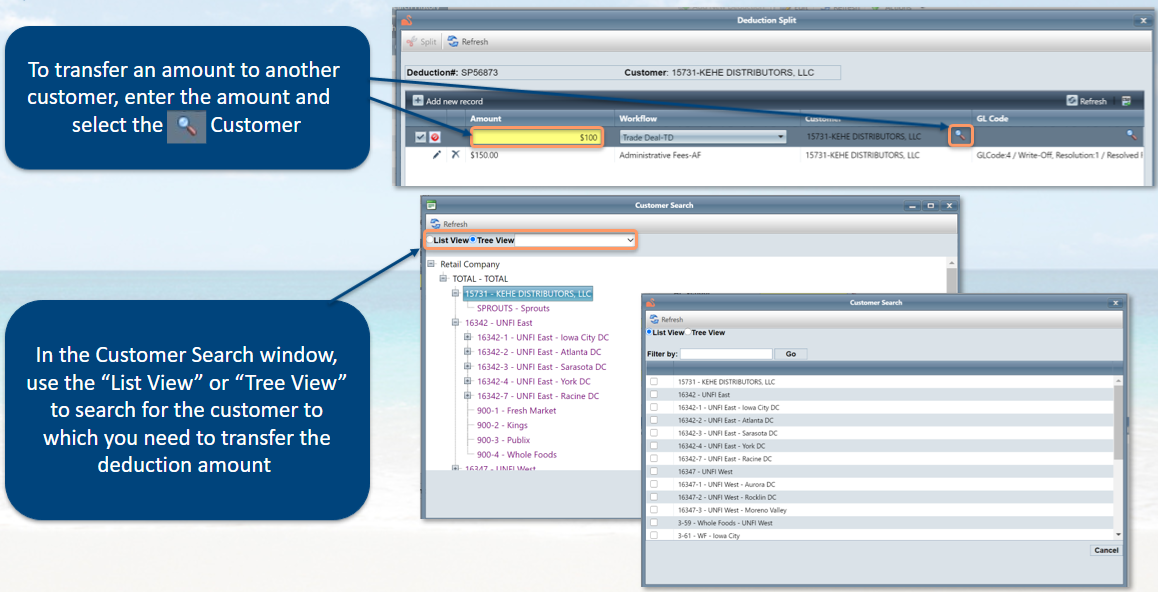

Option 1 - Transfer A Deduction Between Customers

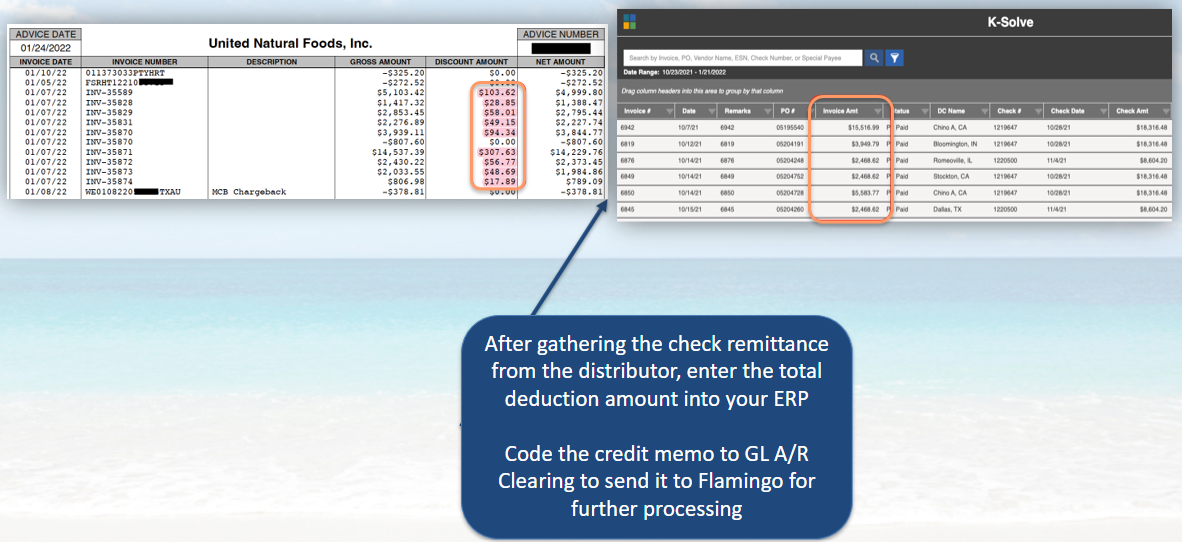

- The Deduction Details screen displays information from check remittance image you uploaded and the amount you entered in your ERP to GL AR Clearing

Option 2 – Non-Trade Deduction – Offset to GL

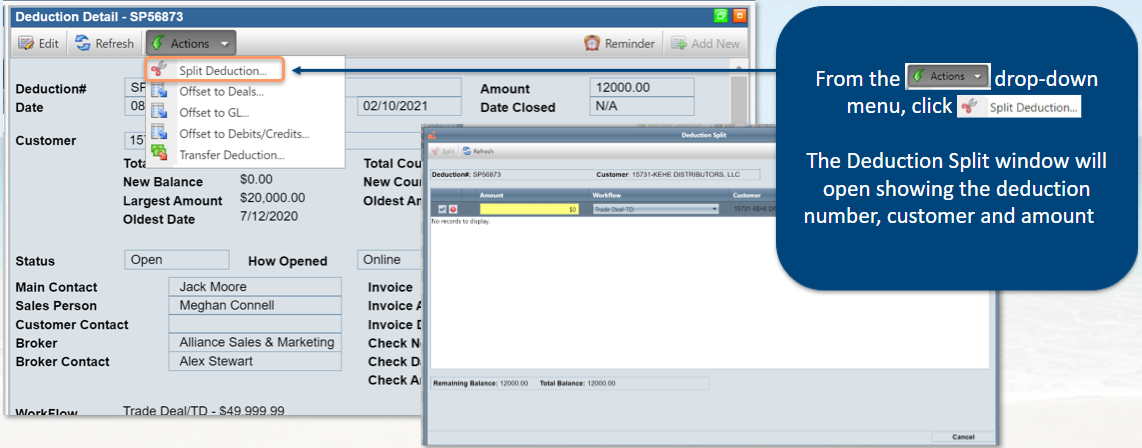

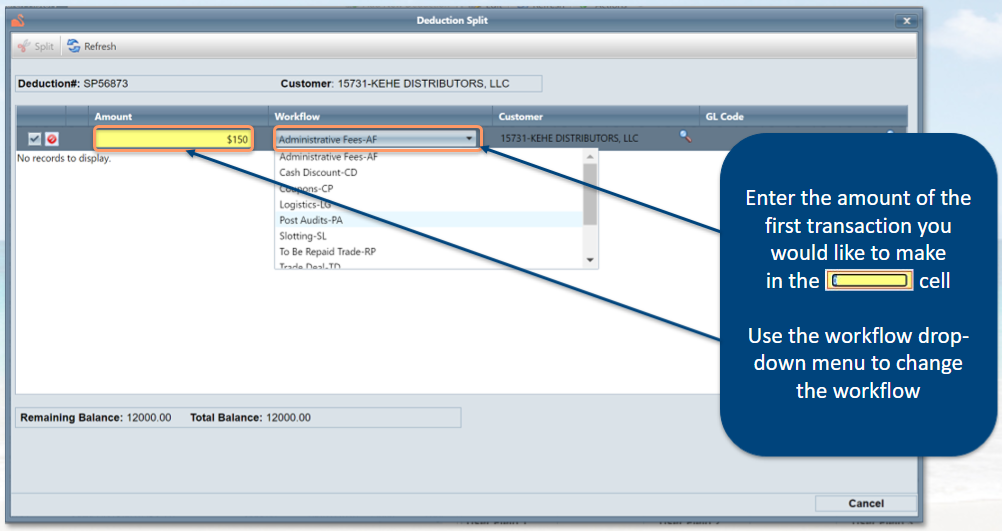

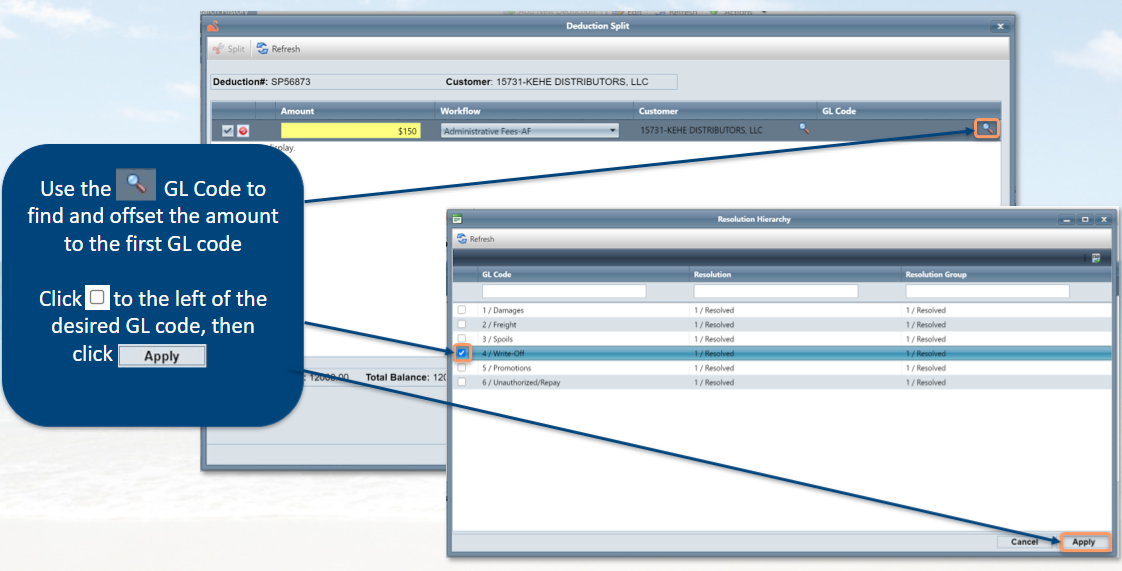

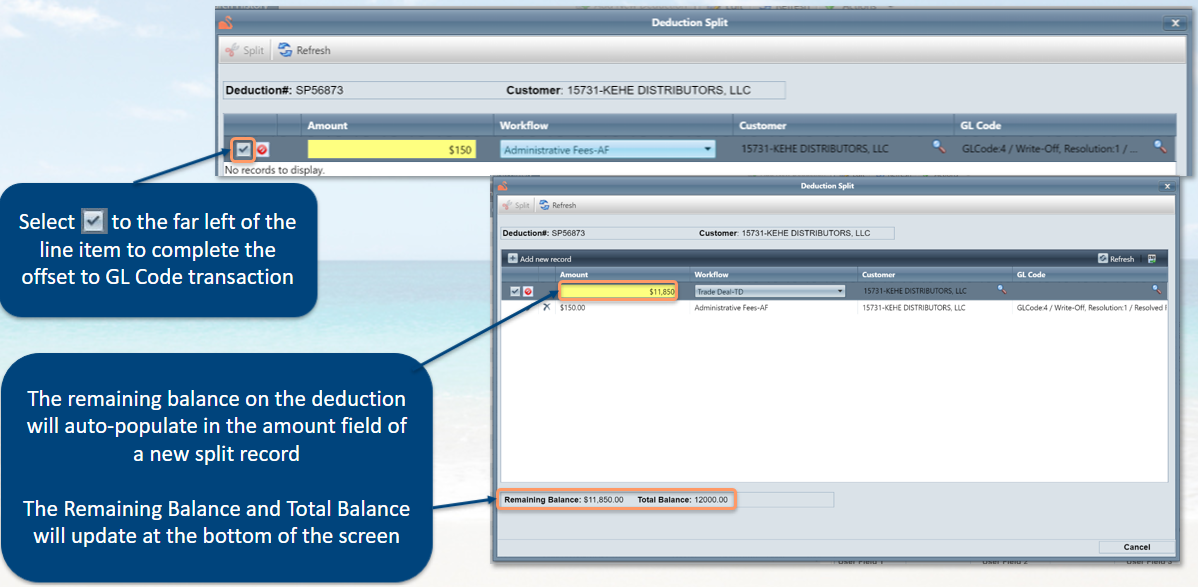

Option 3 – Splitting A Deduction

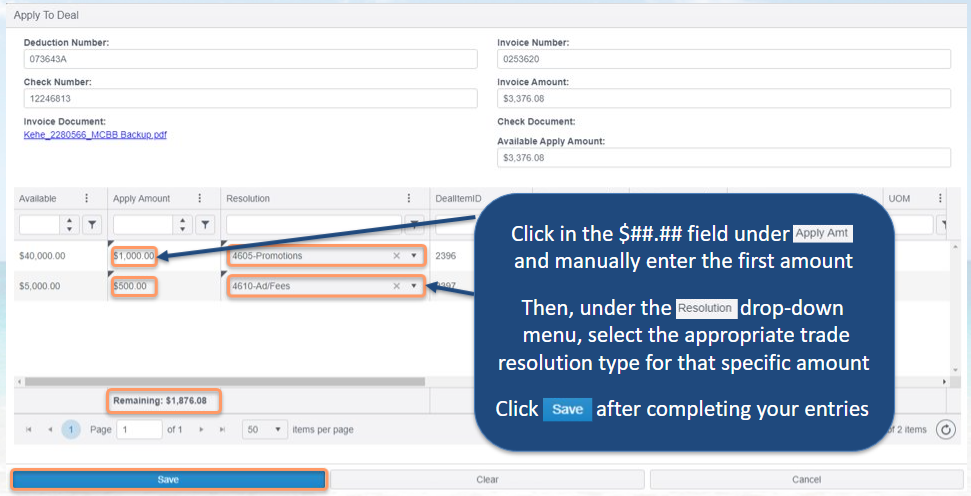

Option 3a – Splitting a Deduction & Applying to Deals

- You will be selecting a trade resolution type of Merchandising, EDLP, Ad Fees, Promotions or OI Discounts from the Resolution drop-down menu and entering the deduction amount specific to that type

- The system will calculate the Remaining $ from the original Available Apply Amount as you enter each amount

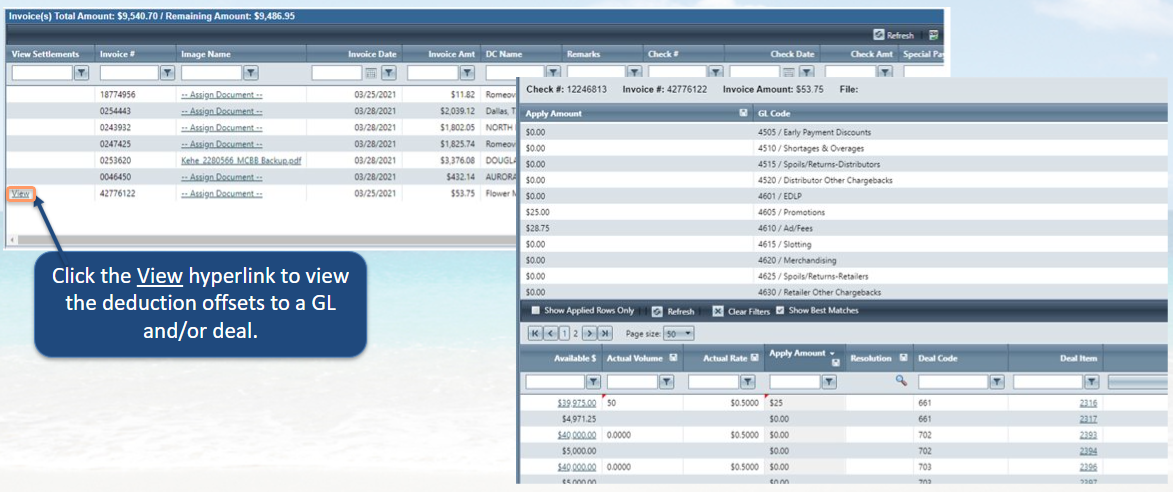

Viewing Deduction Offsets In Flamingo

- Once a line item is offset in the “Boardwalk Offset” section you can navigate back to the Invoice section of the Deduction Detail screen

Note: In the next Boardwalk upgrade, this same information will also be viewable through the Boardwalk Offset section

Managing Other Customers Deductions In Flamingo

Flamingo: A Logical, Simple Deduction Process

Basic Deduction Settlement

Deductions

- The Settlement tab’s Deductions sub-menu is where you will be able to handle any deduction activity including offsetting deductions to trade deals and attaching backup documentation.

- After you run your search, click on the Deduction # hyperlink to open the Deduction Detail screen.

Simple Search

- A screen will display the entire results of your search and individual items opened for review or action

Deduction Detail

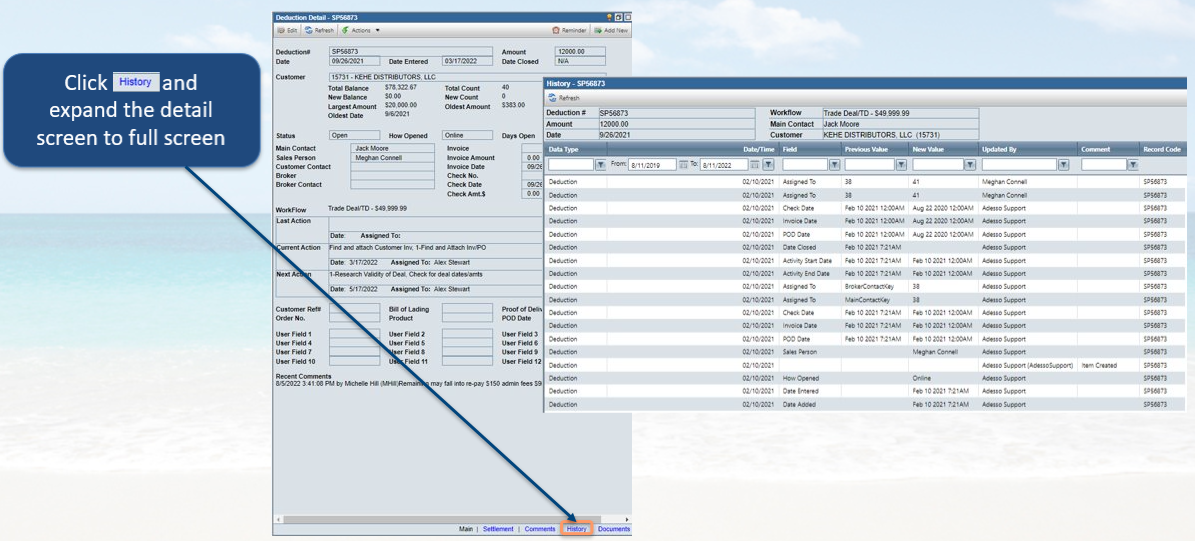

- Basic deduction detail includes information pertaining to the deduction transmitted into Flamingo from your ERP system

- History shows any changes made to the deduction, including how a deduction was closed

Reconciling Deductions

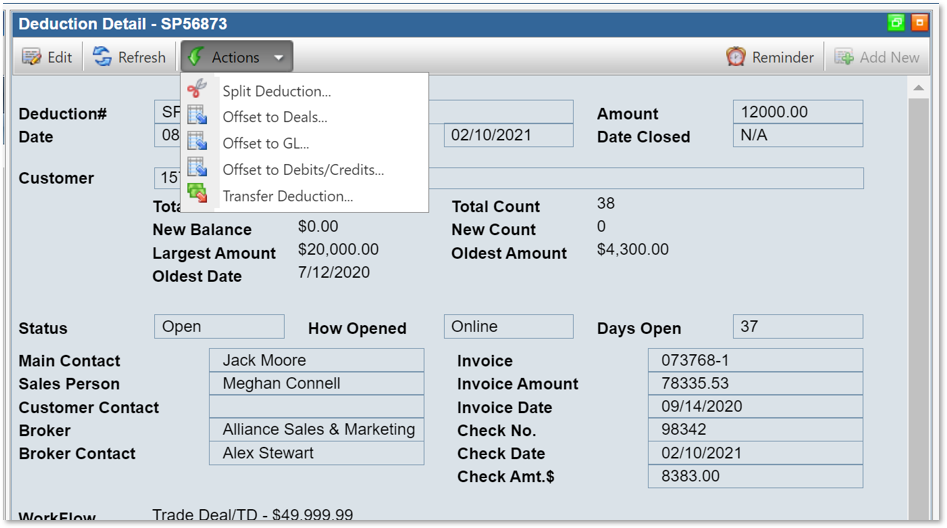

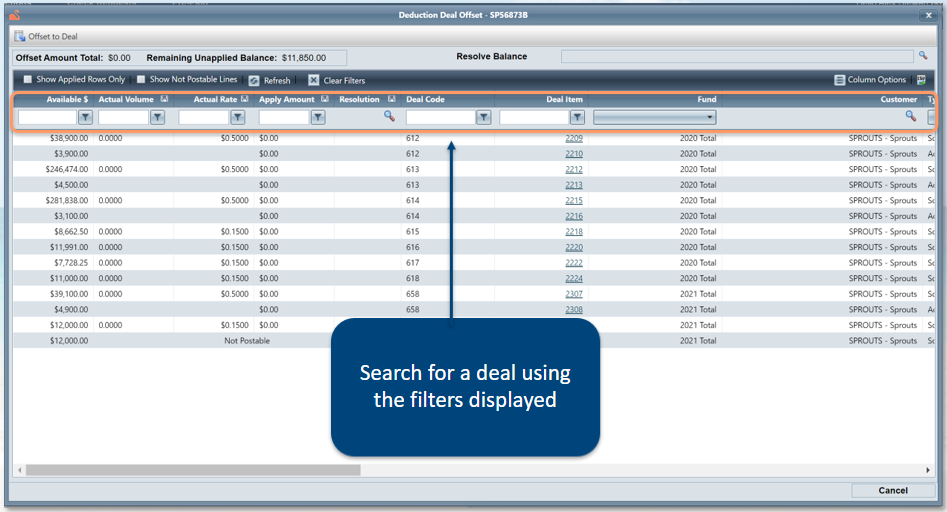

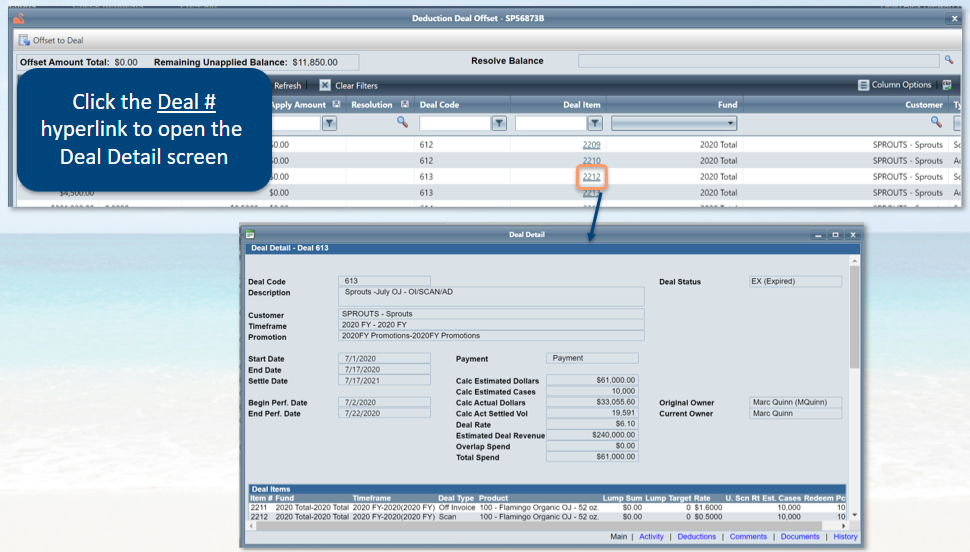

Option 1: Trade Deduction - Offset to Deal

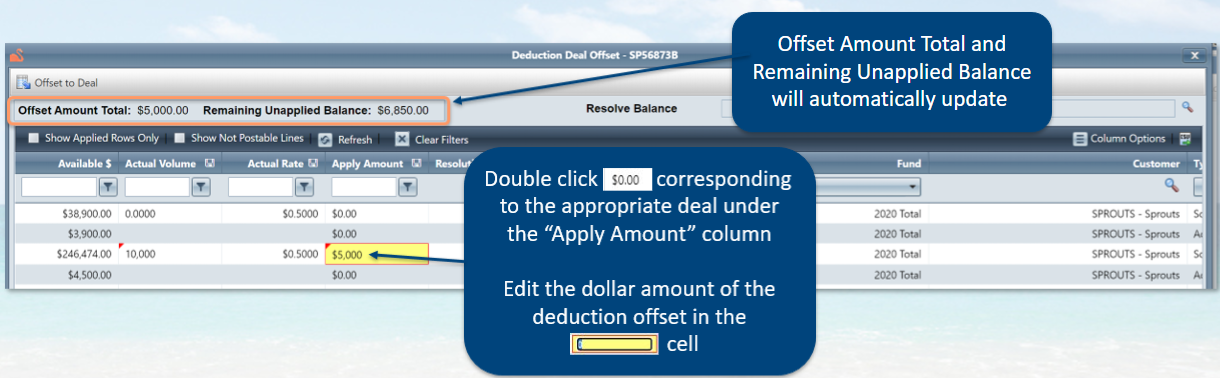

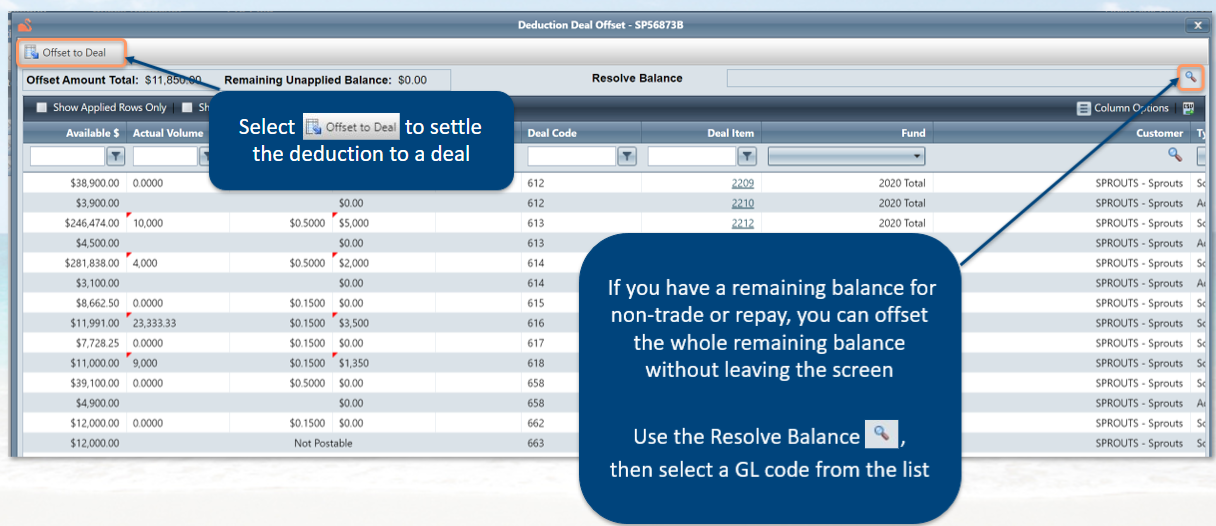

- The Deduction Deal Offset dialog box will be displayed

- Flamingo allows you to offset to more than one deal!

- If a Deal is listed as “Not Postable”, check the status. Only “AC – Accepted” and “EX –Expired” deals are

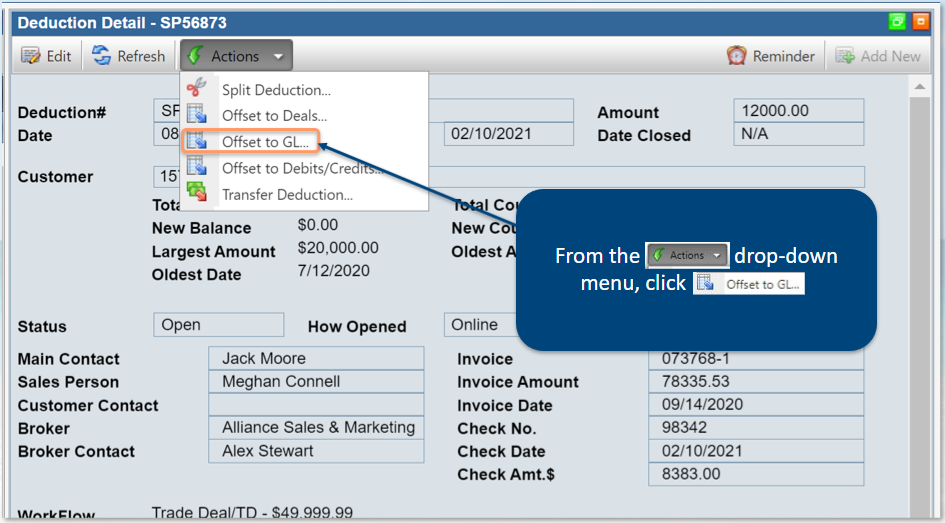

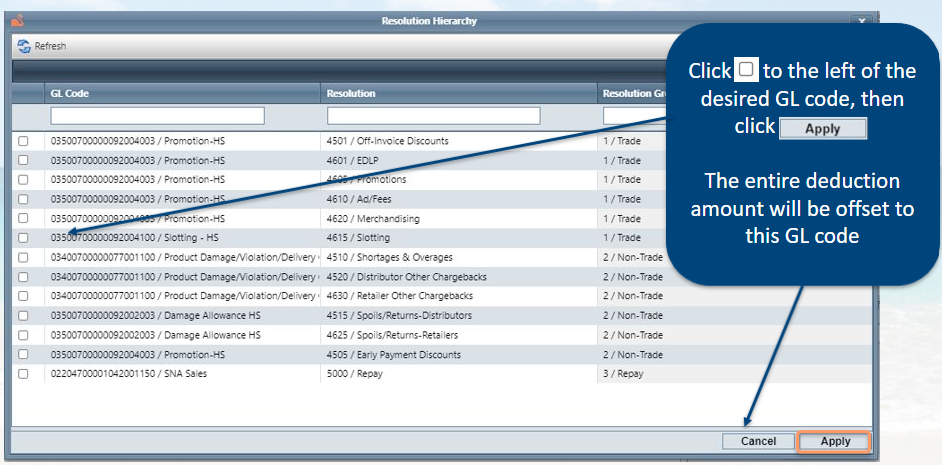

Option 2: Non-Trade Deduction - Offset to GL

- The Resolution Hierarchy window will open and display the GL codes that have been set up in your Flamingo environment.

Option 3: Splitting A Deduction

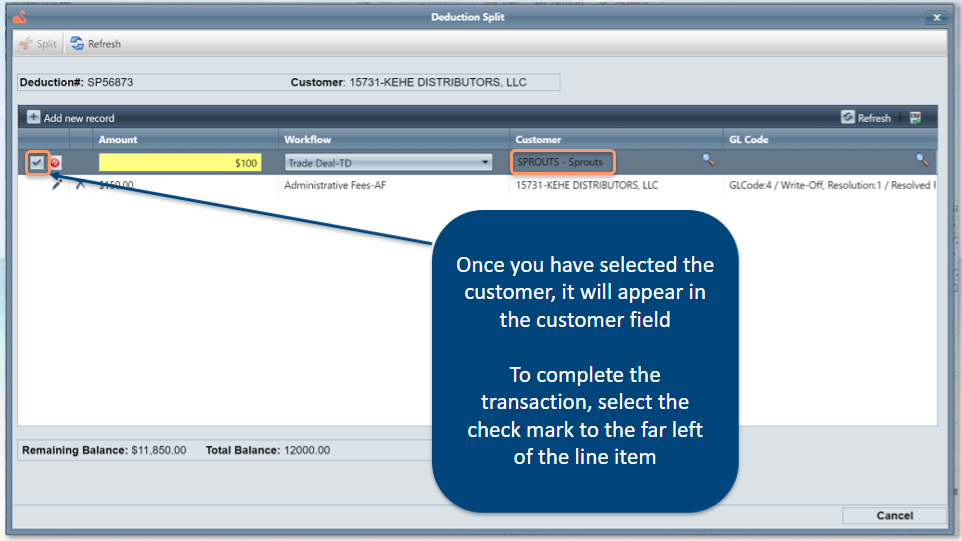

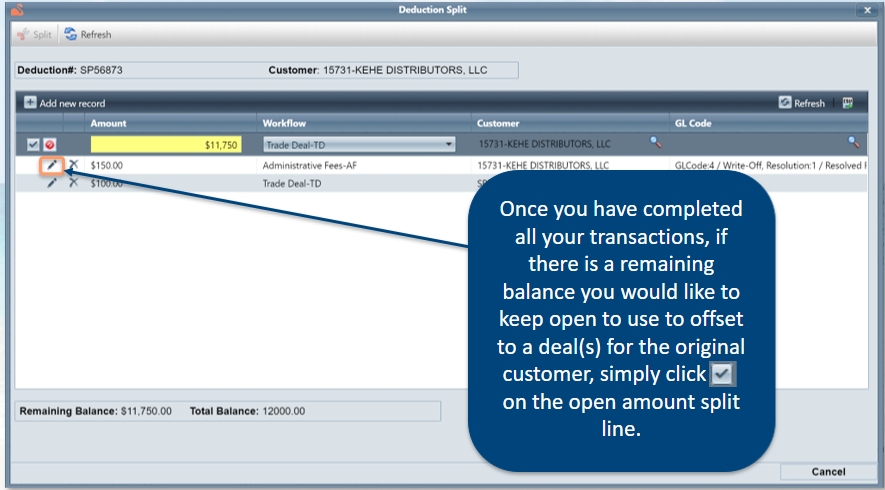

- Splitting a deduction allows for you to 1) offset amounts to multiple GL Codes, 2) transfer the deduction (or portions of it) to multiple customers, 3) leave a portion open to clear against a deal, or any combination of the three.

- You can continue to split the deduction between customers and/or GL Accounts

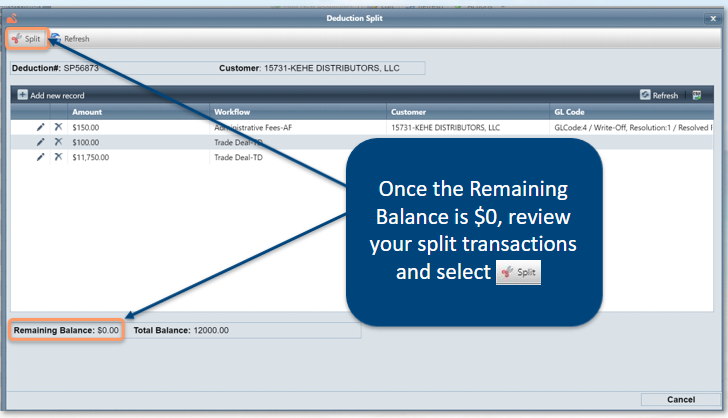

- Once the Remaining Balance is $0, review your split transactions and select Split in the upper left-hand corner of the screen.

Workflow – Deduction Routing

Flamingo Deduction Workflows

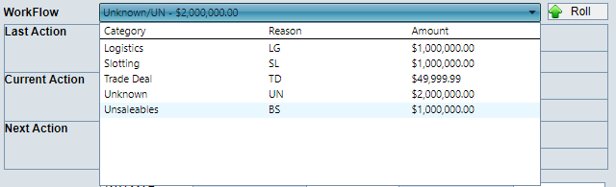

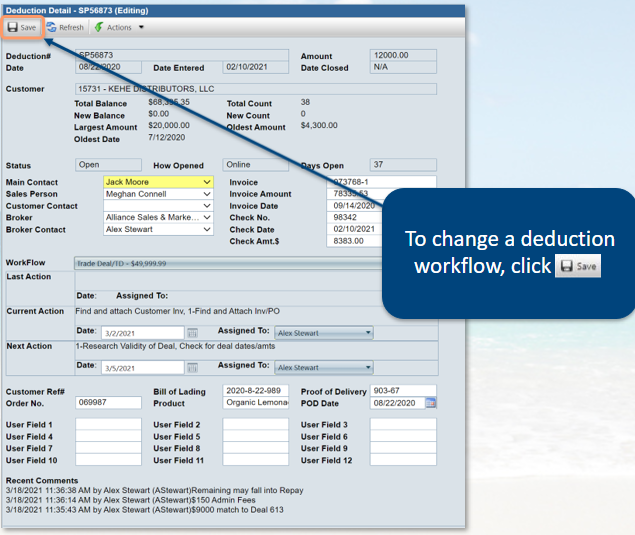

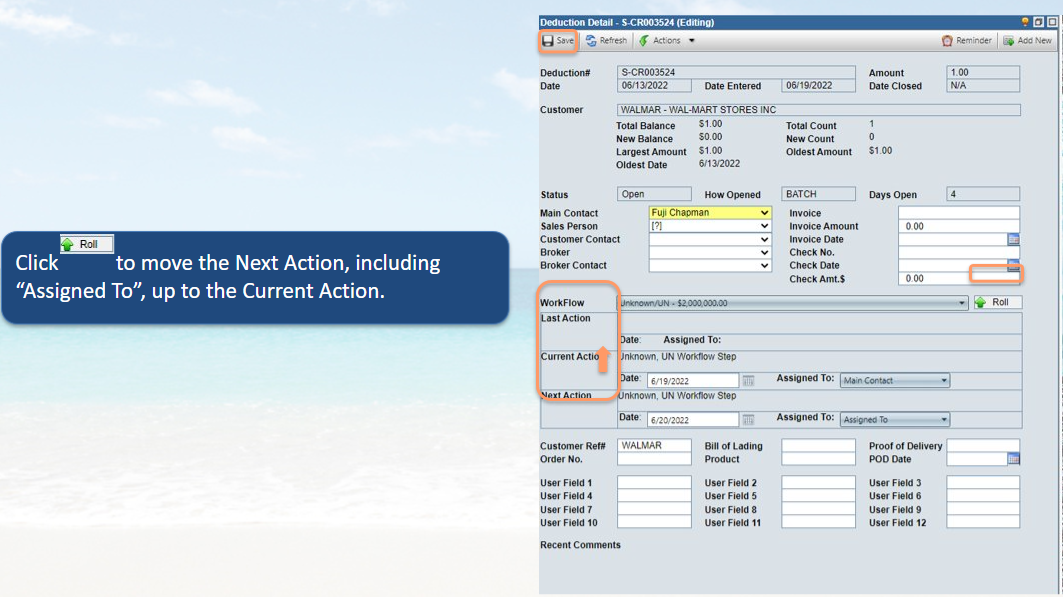

Deduction – Updating Workflows

- The Workflow section of the Deduction Detail will open, enabling you to select the new workflow from the drop-down menu

- You can also reassign the Workflow Action step owner(s) via the drop-down in Current Action.

Deduction – Additional Actions

Deduction Reporting

Flamingo Smart Dashboards

Smart Dashboards Overview

- Data can be altered to meet your specific business objectives

- Reports can be tailored for departments or specific individuals

- Easily extract only the most important data…Customers, Products, ROI, and more!

- Prebuilt chart suites clarify critical data intuitively & quickly

- Powerful and targeted for your specific needs

- Dynamic graphics clarify data

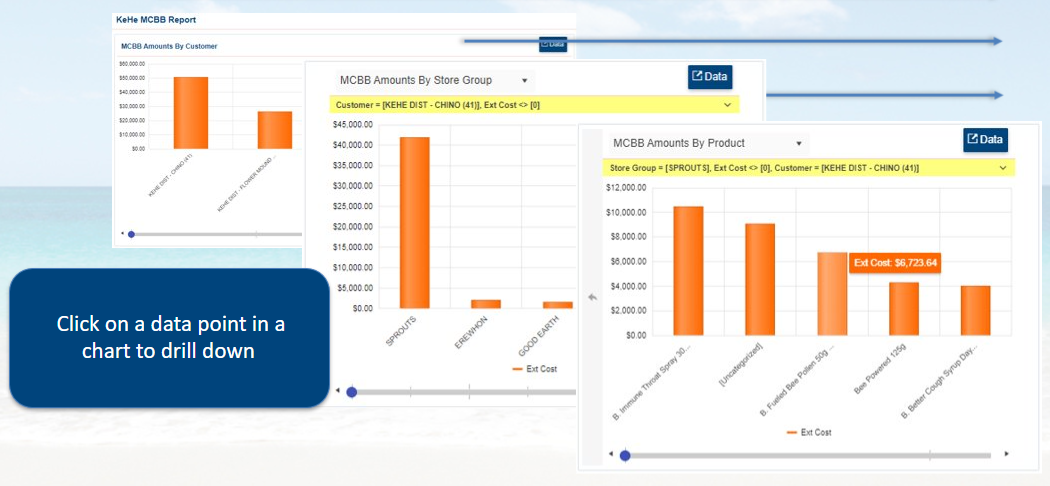

- Analyze granular data belonging to larger data sets using the interactive drill-down functionality built into each chart

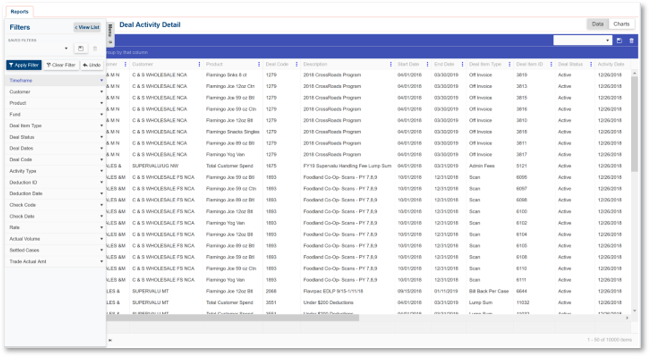

Report Categories

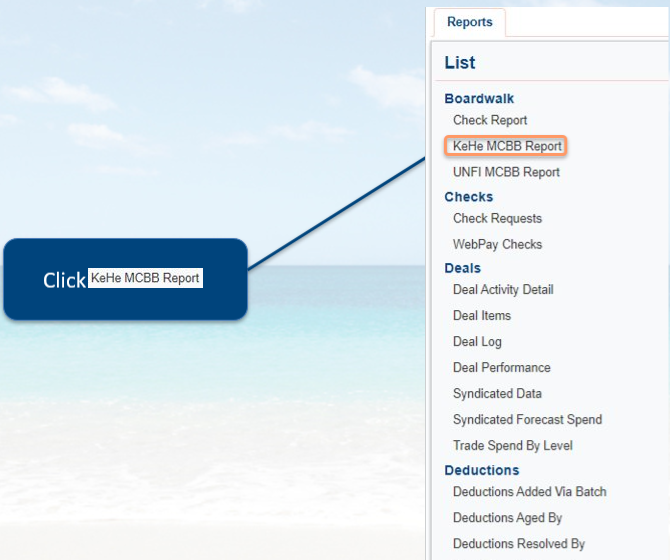

Create KeHE MCBB Report

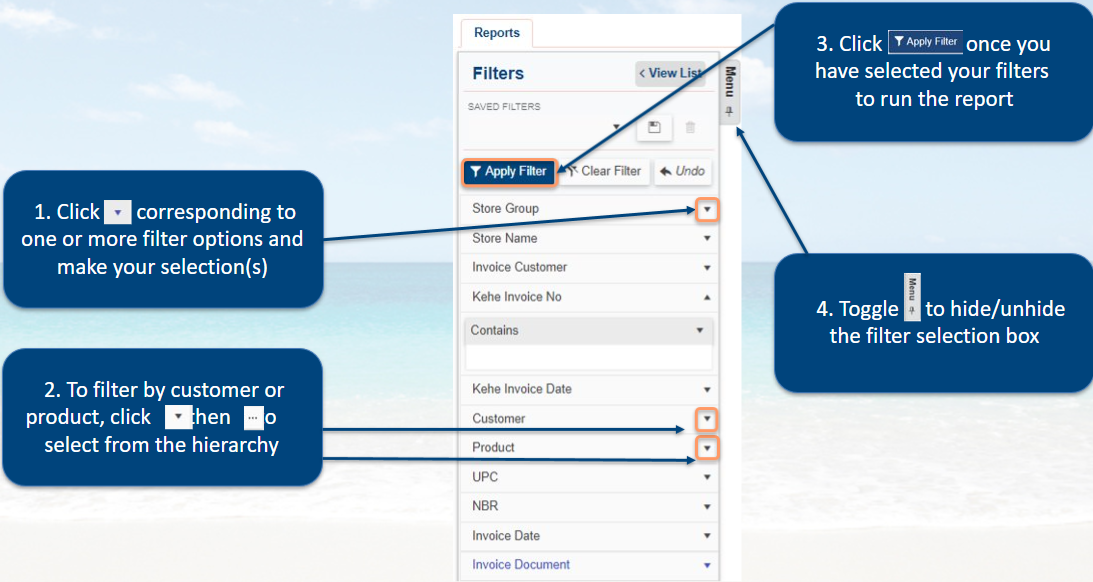

Filters Allow You To Quickly Find Answers

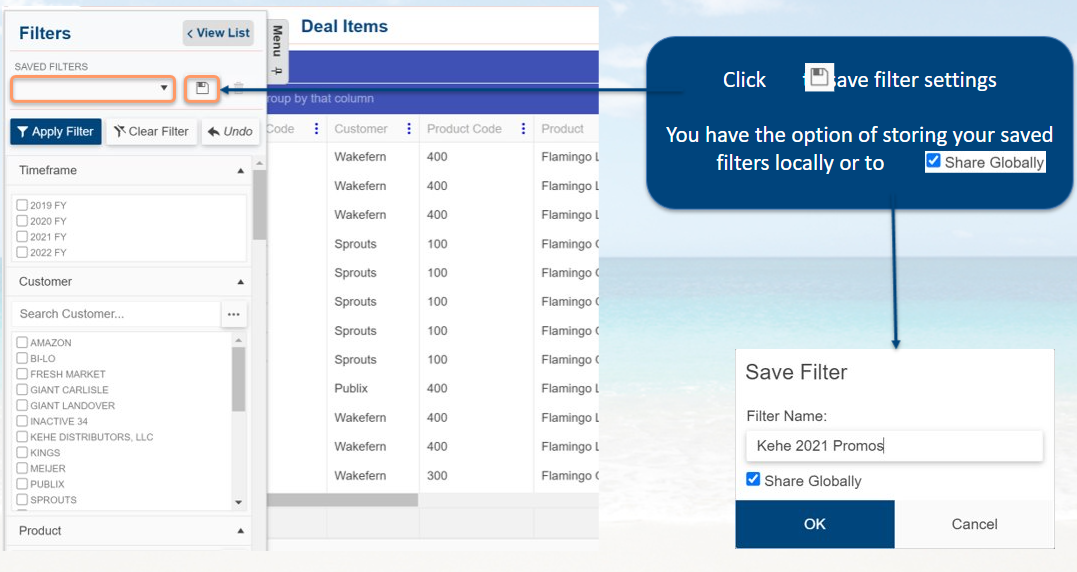

Saving Filters Saves Time

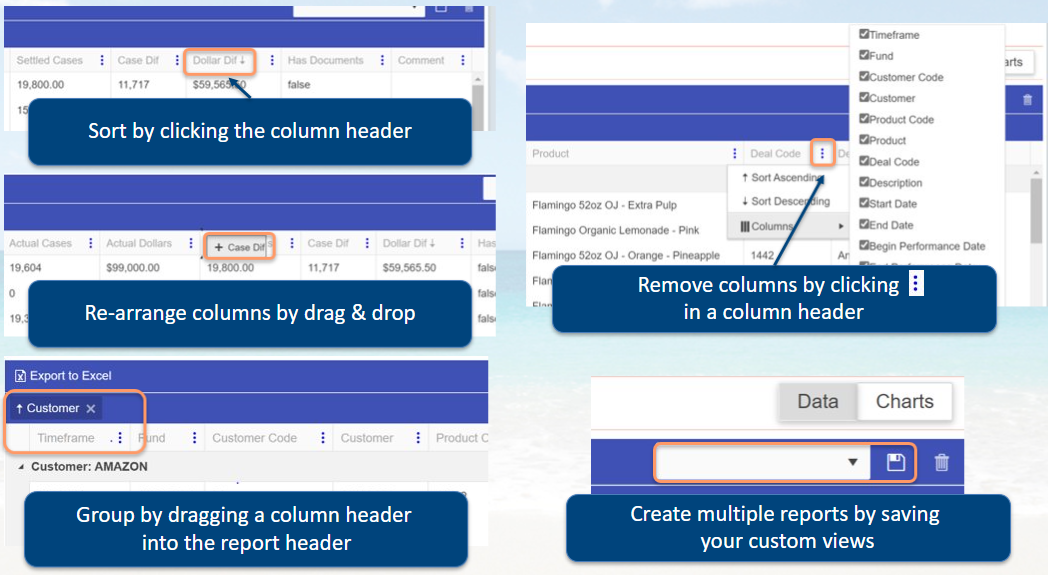

Modify Reports To Make Them Your Own

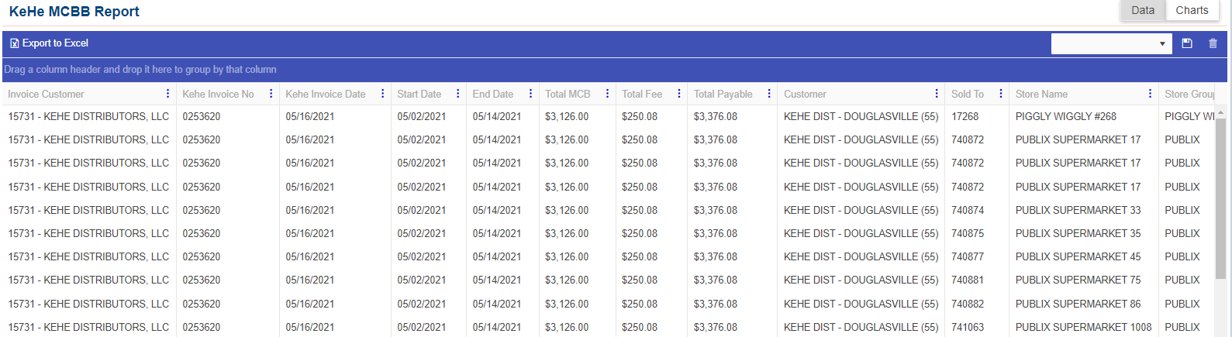

KeHE MCBB Report

- What does this report answer?

- What was the amount of fees included in the backup?

- How much of the backup was associated to MCB deals?

- What amount of the KeHE MCBB backup was assigned by retailer or product?

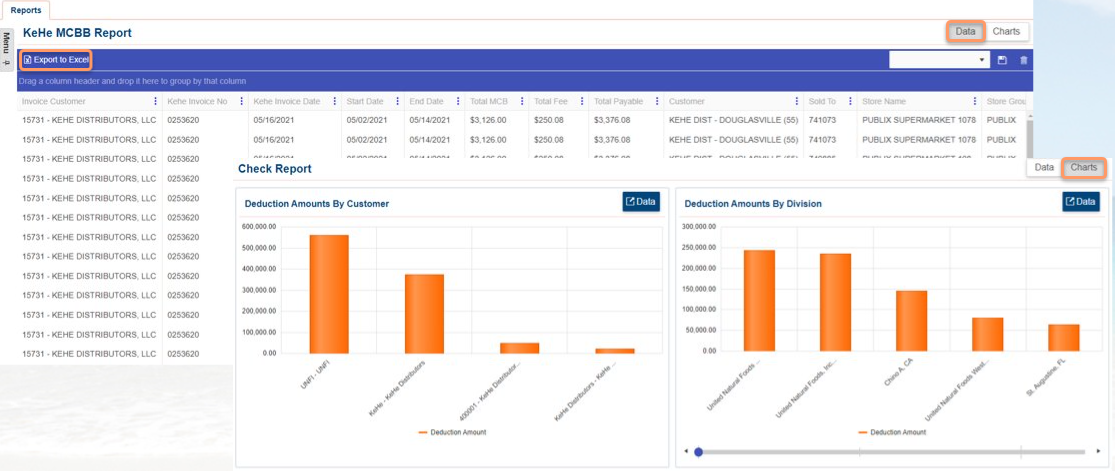

Review Reports As Tabular Data or Charts & Export To Excel

- Use the and tabs to change your view from tabular data to graphical visualizers

- Within the tabular view, you can

Reporting Drill-Down Feature

- Individual charts allow for drill-down functionality

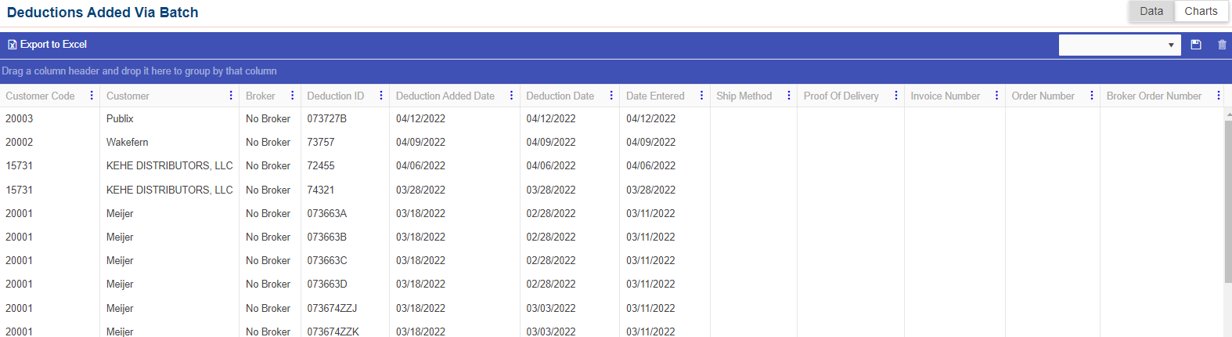

Deductions Added Via Batch Report

- What does this report answer?

- What deductions were added to the system by date?

- When were my deductions entered?

- What are the deduction dates for deductions that were loaded?

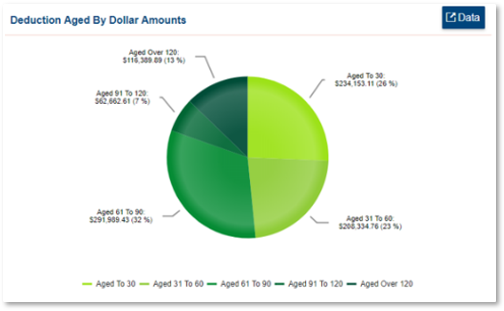

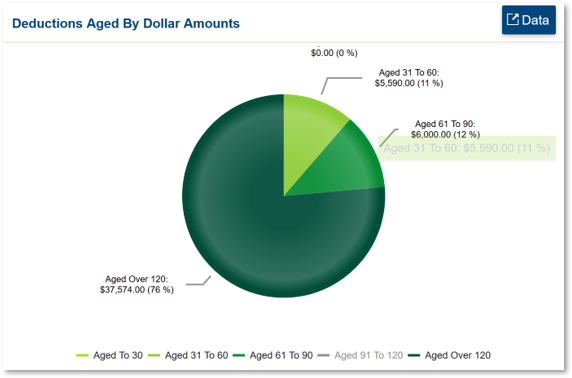

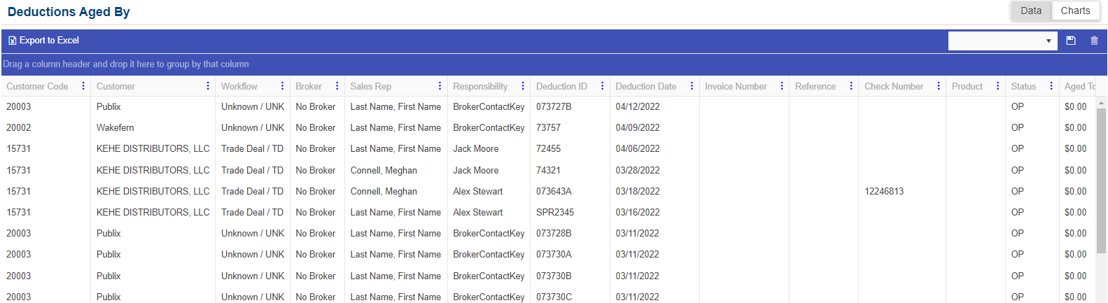

Deductions Aged By Report

- What does this report answer?

- What’s my total aged deduction balance?

- What’s my aged deduction balance by customer?

- Who’s responsible for clearing my aged deduction, as assigned by workflow responsibility?

- Which brokers are not clearing deductions in time?

- What’s my deduction balance by 30, 60, 90, 120, or 120+ days?

- Which customers are responsible for most of my aged deductions?

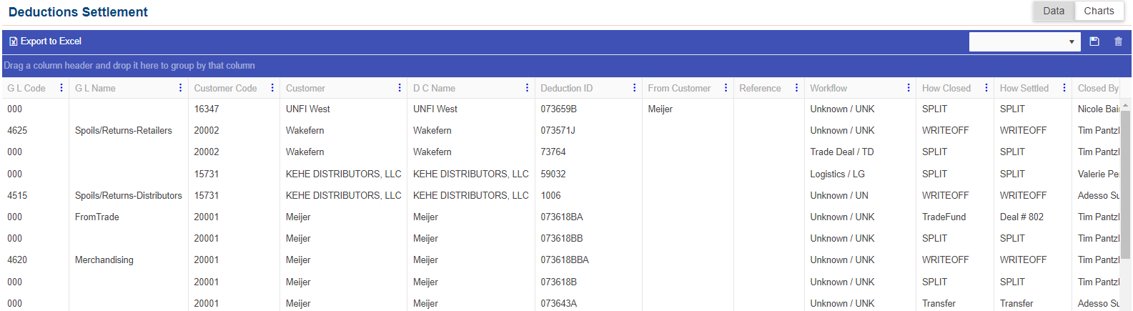

Deduction Settlement Report

- What does this report answer?

- What’s the balance of my general ledger codes by account?

- How much do I have associated to a specific workflow for a given time period?

- Which workflows are being applied to my general ledger?

- How much do I have outstanding in disputed deductions?

- What’s my spend in spoils, logistics, or another account for a given time period?

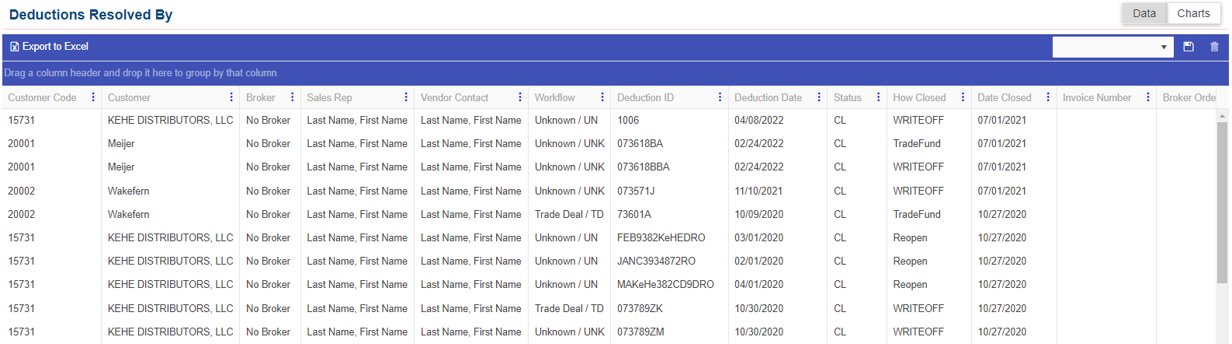

Deductions Resolved By Report

- What does this report answer?

- Which brokers and sales reps have offset specific deductions?

- How have deductions been closed, by workflow, and is it accurate?

- Which brokers have been offsetting deductions to which customers?