How to configure QuickBooks prior to connecting to Flamingo.

Table of Contents

Overview

What is QuickBooks Data Preparation?

This pre-setup step ensures that data from your QuickBooks system is ready to seamlessly transfer to Flamingo once the connection is made.

Why QuickBooks Data Preparation Helps Your Setup

The goal is to ensure your Flamingo TPE setup is as timely and efficient as possible.

By aligning data within QuickBooks as described in this document before establishing the connection with Flamingo, you can save admin time, ensure that your data only includes customers with whom you plan trade, as well as contains key markers that most effectively match your data with standards within Flamingo.

Once the transfer occurs, you simply verify the information transferred correctly within the Adesso Setup Wizard vs. having to make these edits later. You will save significant time, your data will be cleaner, and ultimately this speeds up your overall setup time.

If you have questions, we welcome you to contact us at Support@Adesso-Solutions.com.

GL Names & Codes

Align Adesso GL Names to Your Codes

To simplify your deduction settlement process and improve analysis of your trade, we have developed standard GL Names within Flamingo. These are in the table below along with explanations of what items you would include in these standard ‘buckets’.

Your GL Codes/Numbering sequence can remain what you currently have in your QuickBooks, and by simply adding these additional names to match the Adesso standard names they will transfer into Flamingo when we connect to your QuickBooks system.

Before getting started, be sure to have the “A/R Clearing” account set up. You can have the account number be whatever you prefer, but we require the GL Account Name is set up as “A/R Clearing”. A/R Clearing will store the Credit Memo balances before they are settled to the proper promotion/account in Flamingo.

Standard GL Names & Descriptions

|

Flamingo GL Name |

GL Description |

|

General |

|

|

A/R Clearing |

A/R Clearing is there to store the Credit Memo balances before they are settled to the proper promotion/account in Flamingo. This account also records Off Invoice deals when the invoice comes in, to ensure that the expense transfers from QuickBooks to Flamingo. |

|

Trade |

|

|

Demos |

A store demonstration is an interaction between a manufacturer and a consumer. Most demos are done at store level providing a chance to taste the product and make a purchase. |

|

EDLP / TPR |

Every Day Low Price. This would be a deduction/chargeback (MCB) for an extended price reduction for performance detailed in the retailer agreement/contract. |

|

IRC Coupons |

An IRC - "Instant Redeemable Coupon" coupon is a printed form used in the coordination of many product demonstrations. These are cents off or discounts that are immediately offered at the checkout. |

|

Lump Sum / Fixed Fees |

Includes End-Caps, Displays, Shipper, Case Stacks. These would be a set amount (not a case rate) as a deduction/chargeback (MCB) for merchandising performance detailed in the retailer agreement/contract. Examples: Ad Fees, Display Allowances, and other in-store performance. |

|

Other Trade |

Any other trade performance planning not captured in the above categories. |

|

Post Audit Trade |

Any deductions/chargebacks (MCB) addressed in a delayed fashion (typically up to 24 months) for any performance that is missed or not deducted/charged back by the customer. These should be validated against the distributor or retailer agreement/contract. |

|

Retail Performance Promotions (Other) |

These are performance based case rate allowances for short-term price reductions that are typically paid for short-term price reductions based on what the retailer purchases from the distributor for a specified period of time. These are paid by deduction/chargeback (MCB) as detailed in the retailer agreement/contract. |

|

Retail Performance Scan Promotion |

These are scan promotional allowance, at either a unit or case rate level that are paid by deduction/chargeback (MCB) as detailed in the retailer agreement/contract. |

|

Short Coded Price Reduction |

These would be deduction/chargebacks (MCB) for price reductions due to lack of sales, short coded product, or other in-store activity. |

|

Slotting |

These could be either case rate or lump sum charges for introductory product placement at either headquarter or retail store level that are paid as a deduction/chargeback (MCB) as detailed in the retailer agreement/contract. |

|

Unpaid Off-Invoice Discounts |

These are deductions/chargebacks (MCB) paid for Off Invoice allowances that were either not provided, are outside the OI period, or represent floor stock protection. |

|

Non-Trade |

|

|

Admin Fees |

Any additional charge made by the retailer or distributors, such as a surcharge, charges for initial DC set up, or new item set up, on account of executing the promotional campaign. Examples: Admin fee, surcharge, EP fee, handling costs. |

|

Early Payment Discount |

Credit terms that entitle the buyer (distributor/retailer) to a discount on payment made earlier than the invoice maturity date. |

|

Fairshare / ISE Charges |

Many retailers prefer to have "In-store Execution Teams" to reset and merchandise products in their stores. The costs for this service is passed onto manufacturers instead of the manufacturer or broker providing people to do this work. The fee is normally determined by the percentage of product sold. |

|

Other Chargebacks |

Any other non-trade AP not captured in the above categories. |

|

Other Logistics |

Related to logistics/supply chain. Examples: Unloading fee, pick-up allowance. |

|

Post Audit Non-Trade |

Related to logistics/supply chain. Non-performance penalty billed to manufacturer by third party auditors up to 24 months later. |

|

Shortages / Overages |

Shortage / short shipment. |

|

Spoils / Returns |

Damaged, or spoiled goods. Examples: damaged goods, reclamation charges, bad/unacceptable pallets, returned goods, unsaleable. |

|

Repay |

|

|

Repay |

A deduction/chargeback that is either viewed as not valid, or exceeds the amount agreed to be paid in the retailer agreement/contract. Unauthorized non-trade deductions would be addressed in this category as well. |

Customers

Who to Include & Key Info

Before you import customers from QuickBooks, there are fields you can populate to ensure the right customers and key data transfers into Flamingo. You would select only customers with whom you plan trade (for example, you may exclude something like a Golf Club).

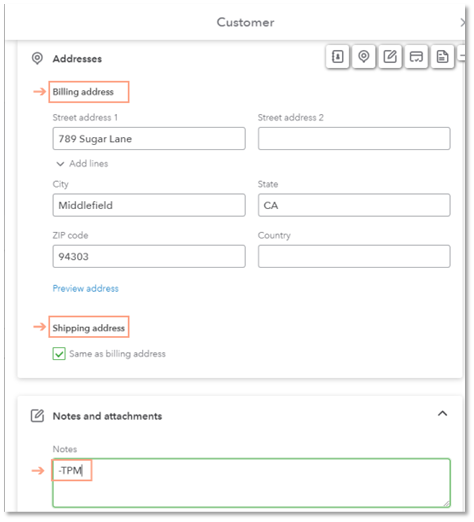

First, to help facilitate which customers to bring into Flamingo you can add -TPM to the notes section on the customer edit screen as shown below. This simple note will flag this customer as one you wish to transfer when the connection between QuickBooks and Flamingo happens. If there’s already information in this section, please add this to the end.

Second, within your customer details, please populate the billing and shipping addresses (if different), so these details will be available to you within Flamingo.

Product

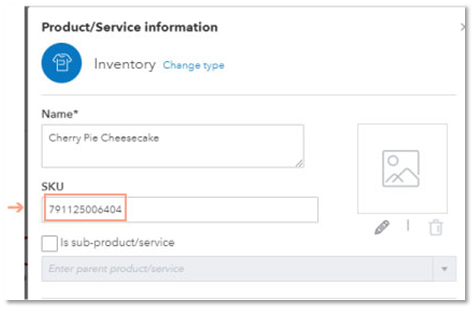

UPC in the SKU Field

When transferring your products from QuickBooks into Flamingo, it is important that you populate the SKU field on the edit screen with the product UPC as shown below.

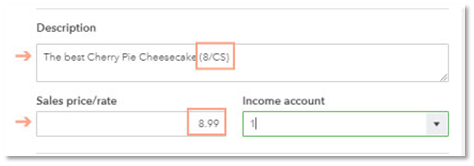

Units/Count & Unit of Measure

For the Units Per Count and Unit of Measure, enter as (Units Per Count/Unit of Measure) as shown in the example below at the end of the description field.

Please note that Units of Measure supported include: CS: case | Lb: pounds | BG: bag | PL: pallet

Enter the standard product price in the Sales price/rate text box a shown below.